Credit management is integral to accounts receivable management.

Good credit management supports consistent cash flow, smooth payment collections, customer satisfaction, and much else.

It matters even more for companies working in the business-to-business (B2B) space. Getting B2B credit management right can make a huge difference to a company’s success and growth…

What is credit management?

Credit management is a business term describing everything related to the processes involved in managing payments, from the point where you extend credit and offer payment terms, through to payment collections.

It covers multiple different smaller components involved in issuing, monitoring, and collecting credit. Each of these is linked to – and should be coordinated with – a larger overall whole: the credit management process.

At its core, credit management is the caretaking of a company’s financial health. Doing it well can mean the difference between a company surviving or thriving.

What is B2B credit management?

Business-to-business (B2B) credit management is a term that applies to the credit management system or practices carried out by most businesses that work primarily with other businesses.

The distinction between B2B and business-to-consumer (B2C) businesses and consumers is useful in general because it describes the broad features of each category. These features also influence B2B credit management, too.

For example, B2B businesses often extend credit before payment for relatively high-volume sales with relatively slow payment cycles. Complex and reliable strategies are needed to manage credit under these conditions. Understanding trade credit and its role in B2B transactions is crucial for effectively managing credit relationships and ensuring smooth operations.

Global Credit Management

Global credit management encompasses varied approaches influenced by economic conditions, cultural norms, regulations and technological advancements. Recognizing these nuances is crucial for businesses operating internationally.

- Economic Variability: Economic factors shape global credit management strategies; emerging markets rely on alternative financing, while mature economies offer diverse credit products. Understanding economic disparities guides tailored credit policies.

- Technological Advancements: Fintech innovations streamline processes, enhancing credit risk assessment globally. Embracing technology optimizes credit operations, ensuring competitiveness in international markets.

- Cultural Dynamics: Cultural attitudes toward credit vary by geography. Some cultures favor conservative approaches, while others embrace credit for growth. Recognizing these cultural nuances informs effective global credit strategies in diverse markets.

- Regulatory Impact: Regulatory frameworks impact global credit management practices. Stringent regulations prompt conservative policies, while relaxed oversight increases global credit risk. Adapting to regulatory landscapes ensures compliance and risk mitigation.

- Supply Chain Resilience: Global credit management strategies must consider supply chain dynamics including adapting to supply chain challenges ensuring continuity and resilience.

- Cross-Border Trade: International trade complexities require robust global credit management. Currency fluctuations and regulatory compliance impact credit decisions. Effectively managing cross-border credit risks maximizes opportunities for global expansion.

Principles for a successful B2B credit management system

1. Set a credit policy

Creating a clear and detailed credit policy is the first step in the process of laying down a solid foundation for your B2B credit management system.

A credit policy is a framework or set of guidelines and rules that businesses or organizations establish for managing credit operations.

It lists the terms and conditions for extending lines of credit to customers. These include credit limits, payment terms, interest rates, late fees, and more. It also outlines the following:

- How to define credit limits (the maximum amount a customer can borrow)

- How to define credit terms (when payment is due, discounts, and late fees)

- How to record transactions

- What actions to take for nonpayment

Keep your policy up-to-date

As new events occur and solutions to credit checks are provided, your credit policy document should be updated. This will ensure your B2B credit management offering is always in step with business decisions.

2. Create a hierarchy

Creating a hierarchy system within your credit management team can help resolve blocked or bottlenecked issues.

It will also help guide broader relevant questions around the procedure, communication channels, and delegation.

3. Establish a creditworthiness assessment process

How much business credit you can offer a customer depends on how creditworthy they are. To gauge creditworthiness well, there are several factors to consider.

You can use Dun & Bradstreet and/or Experian to check credit reports and determine many businesses’ payment history.

You can also call a businesses’ references and creditors directly or view their financial statements as part of the credit application.

Factors for evaluating creditworthiness

Average days sales outstanding (DSO) needs to be balanced against supplier terms so that your cash flow remains steady.

If bad debts are increasing, finding their source may uncover problems in your credit approval process.

4. Regularly evaluating credit offerings

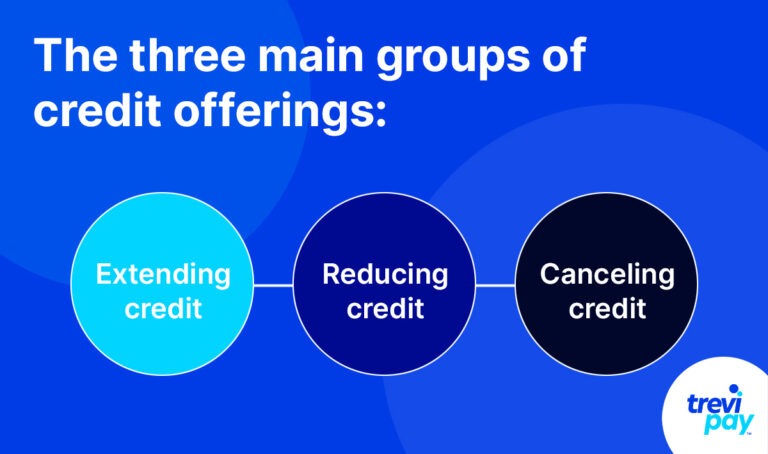

Credit offerings can be categorized into three main groups.

- Extending credit: Providing credit for new customers or more credit for an existing one

- Reducing credit: Restriction of an existing customer’s credit. This reduces your risk if a customer’s business is in decline, or their payments are late

- Canceling credit: Discontinuing credit offerings and moving a company’s payments into collections

New customers

In general, new customers are higher risk. Their creditworthiness and credit history need both to be determined remotely because you have no experience and knowledge either.

Existing customers

It’s easy to become complacent and think of existing customers as low-risk. You might even miss warning signs.

To reduce the risk of customer defaults, existing clients should go through a periodic credit review and have their credit terms adjusted accordingly – if needed.

Global Customers

Expanding globally brings both opportunities and risks. Assessing the risk level of international customers involves checking their financial stability, credit history and legal compliance. Cultural understanding is also key for successful partnerships. By doing thorough research and staying compliant, businesses can navigate global markets confidently, seizing opportunities while managing risks effectively.

Communication

The reasons behind decisions on new or adjustment credit rates should be documented and accessible to customers. Transparency builds long-term trust in customer relations.

5. Optimize (or outsource) B2B collections

There are several B2B collections best practices you can follow and cross-reference to ensure smoother payment collections.

Either way, chasing late accounts and payments yourself can drain your resources. Using a collections agency can be a viable alternative.

6. Provide a customer portal

If your accounting software enables it, being able to provide an online customer portal can be beneficial.

It will allow customers to securely log in and view invoices, statements, available credit, request a credit increase and make online payments.

TreviPay’s B2B-specialist credit management solution

Overwhelmed by the prospect of managing the B2B credit process? TreviPay can help.

Our accounts receivable management and processing tools enable you to outsource manual and cumbersome processes from credit checks all the way through to collections.

Just as importantly, TreviPay also takes on all responsibility for risk. This allows you to extend lines of credit without risk being reflected on your balance sheet.

Learn more about TreviPay or contact our specialists to sign up for a demo today!

Summary

B2B credit management involves many related parts. Taking time to plan your process while considering what’s right for your company and customers will help create a successful credit management policy that works for all parties.

Good B2B business credit management helps build steady cash flow for your business. Not only that, offering customers a line of credit means they can buy more goods or services from you without using up their own valuable cash flow to pay you.

Start by first laying down a solid foundation and creating a documented credit policy.

When analyzing your credit management, you need to consider market trends, collections, and your definition of favorable terms.

Review your customer base to determine their creditworthiness, how to extend and adjust credit lines.

But don’t forget that b2b credit management systems are not just behind-the-scenes processes. Look for ways to embed b2b credit into a great customer experience that can be delivered seamlessly via an online portal.