Invoice factoring can improve cash flow and free up time and resources.

Many different kinds of businesses use it. But because they are different, so too are their invoice factoring fees.

To determine if invoice factoring is the right solution for your company, and how much it will cost, you should consider it in the context of your industry and specific business situation.

A first step toward this is understanding how invoice factoring costs are calculated. This article will help you with that.

But first, let’s look briefly at some background information.

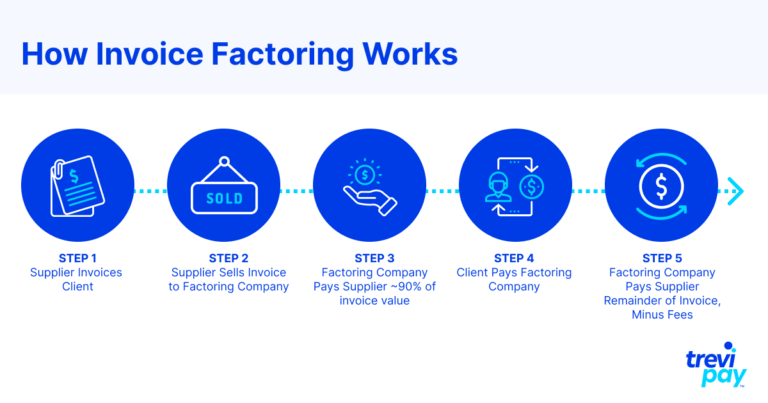

How invoice factoring companies work

Invoice factoring companies specialize in processing invoices on behalf of other companies. They can be stand-alone companies or subsidiaries of other entities in the financial industry.

Invoice factoring is not to be confused with another kind of invoice finance: invoice discounting. The latter is when a company puts up its existing invoices as security for what almost amounts to a bank loan.

The main difference between the two is that the former includes business services other than just lending capital. This means invoice factoring is usually a more expensive – but more comprehensive – service than invoice discounting.

It’s one of a number of financing options available to businesses.

Notification vs non-notification factoring

Buyers (i.e., those paying the invoice) may or may not realize they are dealing with a third-party invoice factoring company.

This depends on whether their provider is using a notification (when buyers know that a third party is processing the invoice) or non-notification factoring facility (when they don’t know).

Most factoring companies provide notification factoring. Setting up non-notification factoring takes more work but qualifying for it usually requires more stringent criteria, which itself may bring down costs.

Recourse vs non-recourse factoring

Most factoring companies offer a recourse factoring service. This means that if the buyer doesn’t pay some or all of the invoice, the provider (not the factoring company) must cover the costs.

Non-recourse factoring is when the factoring company undertakes liability for each invoice. Because of the obvious risk, this type of factoring costs more and qualifying for it requires a better credit rating.

Is invoice factoring right for your company?

There are different kinds of invoice finance. Whether invoice factoring in particular is cost–effective for you usually depends on whether you need to improve cash flow in order to maintain or increase turnover.

You can use an invoice factoring facility with only some higher value accounts or for a short period of time. Perhaps, for example, sudden growth has temporarily overwhelmed your accounting facilities that were set up to process a lower volume of invoices.

Invoice factoring costs would be a wasted expense if you don’t need your invoices paid immediately – after all, it does reduce the total amount of invoice value that you receive.

The basic components of invoice factoring costs

There are two basic parts to invoice factoring fees:

- The discount fee + the service fee

For both of these, there are average base rate cost ranges within invoice factoring generally. However, this range on its own isn’t very instructive because fees usually depend on multiple factors (see below).

Let’s look closer at these two main components of typical fees.

Discount fee

The discount fee (sometimes known as the discount rate or factor rate) is the fee the factoring company charges for factoring an invoice.

It is calculated as a percentage of the invoice value and usually ranges from between 1.5 – 5%. The discount rate only applies to the funds advanced. It is often calculated as an annual rate then charged on a weekly or monthly basis.

For example, if it was 5% of your total invoice value, and you used invoice factoring for a single $100,000 invoice with a 30-day term each year, you would pay $410.95 ((5,000 ÷ 365) x 30).

It can basically be considered an interest rate on the advance provided by the invoice factoring company.

Service fee

A service fee is essentially an administration fee that factoring providers charge for a range of services around processing and managing invoices.

It usually lies in the range from 0.5 – 2.5% of the value of invoices factored. As with the discount charge above, its precise figure depends on multiple factors.

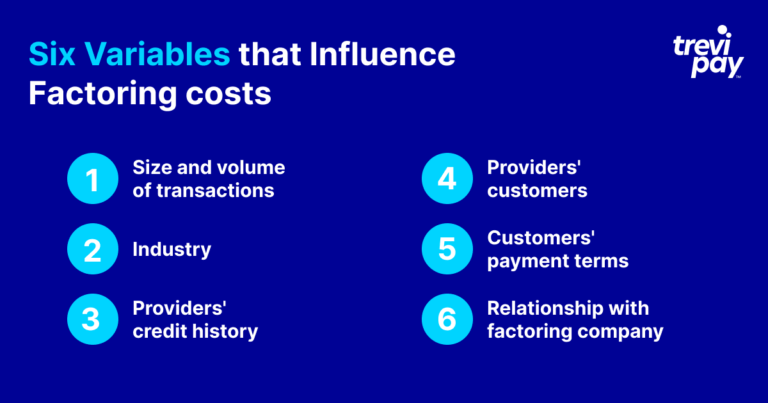

Six variables that influence factoring costs

The specific rate of the factoring and service fees depends on multiple variables. Many – but not all – of them are out of your direct control and some may vary depending on the factoring supplier.

Below is a list of some of the key variables to consider.

1. Size and volume of transactions

The size of each invoice and their volume will significantly influence your factoring fee.

If you are able to guarantee a high volume of invoices, a factoring company will likely offer lower factoring fees.

Conversely, it is in your interest to have your invoices factored less frequently because this reduces the cost of factoring. I.e., processing one $20,000 invoice costs less than processing two $10,000 invoices, which costs less than processing four $5,000 invoices, etc.

In short, to keep costs down, it is in your interest to have larger invoices factored less often.

2. Industry

Certain industries have a higher risk factor than others. There are multiple ways to measure risk, but generally speaking, there is a consensus on which industries have the highest risk.

Industries such as retail, agriculture and even accounting, for example, are seen as relatively high risk. Gambling and alcohol even more so. Whereas others, such as scientific research, laboratory wholesalers, and even flying schools, are seen as low risk.

The cost of factoring will reflect each industry. One way you can potentially reduce this factor is to look for invoice factoring companies that specialize in your industry.

One example for this is factoring for the freight broker industry. Freight carriers may need this service because of the difference in terms between shippers and carriers.

3. Providers‘ credit history

One of the key factors for a factoring company deciding rates (or even fee structure) is the state of your existing credit management.

The factoring company may carry out credit checks (see below) early on to determine your financial health. Bad debts and poor credit over a long period will increase the risk to them. The factoring fee they offer will reflect this.

4. Providers‘ customers

The payments and punctuality track record of your customers will also influence invoice factoring fees.

If you have a backlog of outstanding invoices from customers, an invoice factoring company will sense a high degree of risk from working with you. This could lead them to quote higher rates (in order to cover their credit protection) or even declining to work with you.

The discount charge that the factoring company may quote will reflect their perception of risk of late payment or defaulting from your customers.

5. Customers’ payment terms

Most invoices have payment terms of 30 days. If your business has previously agreed to a longer period (60 or even 90 days, for example) then factoring charges will often be higher.

The factoring company may simply charge the same discount charge over this period. This is because the longer it takes for them to receive payment, the more risk they are exposed to.

6. Relationship with factoring company

As with businesses everywhere, relationships in the invoice finance industry are important. This is because trust is a particularly important factor in the processes involved.

Over time, your company can develop a relationship with an invoice factoring provider that may also lead to a better financial understanding, resulting in a lower base rate for the service or discount rate.

This could be based on your general reliability, business growth potential or positive market developments.

4 other possible factoring charges

Below is a list of potential additional costs that might come with invoice factoring.

1. Sign up fees

Some factoring providers may charge some form of a sign-up fee (sometimes referred to as a set-up fee, origination fee or application fee).

This isn’t a part of every company’s fee structure but it is worth remembering when seeking a provider. In some cases, especially if your company has an excellent credit history and high turnover, it can be waived.

2. Credit check fees

Credit checks are a necessary part of the process for factoring companies.

Releasing the cash for invoices (especially high-value invoices) that go unpaid could disrupt a factoring company’s own cash flow – an essential part of its business.

A factoring provider will look at your key finance figures, such as turnover and profitability, to calculate what rates to offer.

3. Late payment fees

The likelihood of late payment of invoice varies for every business, depending on its industry and customers. Late payments will disrupt the factoring process and may come at a cost you (unless you are using a non-recourse factoring provider).

4. Contract termination fees

Some factoring companies may include a termination fee clause in their contract.

To avoid these fees, you should think carefully about how long you need a factoring facility before signing a contract.

You should consider whether your issue with cash liquidity is ongoing or temporary and whether the volume of invoices you need factoring justify the cost of factoring.

Conclusion

Invoice factoring is an efficient and popular type of invoice finance. It works well for companies that need to quickly improve cash flow.

Invoice factoring costs are likely to be cheaper than a bank loan and comes with a useful invoice processing service.

The basic fee structure is usually similar between providers.

However, the specific factoring charges depend on which type of invoice factoring (notification or non-notification, recourse or non-recourse) are used.

Generally speaking, high-value invoices and a larger turnover brings lower fees.

While factoring fees can vary widely, you should now be able to anticipate how your business will be evaluated by service providers.