Small Business Supplier Network (SBSN)

The First Payment Network Built for Banks and their Small Business Customers

SBSN provides real-time, risk-free and debt-free payments for your B2B SMB customers, eliminating accounts receivable just like credit cards did for B2C retailers, giving your bank a healthy revenue stream.

SMBs are a Bank’s Largest Growth Opportunity

SMBs extend $5 Trillion in B2B trade credit to customers every year in the U.S. alone.

SMB customers want 30+ day credit terms but their employees need to be paid weekly.

Current financial solutions finance less than 15% of SMB trade credit extensions.

How it Works

Small Business

Unleash small business selling power. Empower SMBs to finance their own growth instead of financing their customers’ purchases.

Small Business Supplier

Network

A fully integrated payments network, running in parallel with card payments, to deliver a structured financial service through a white-labeled partnership with banks.

Financial Institution

Extend small business financial services safely and profitably into the untapped B2B trade credit market and grow a new fee-based income stream.

Benefits for Member Banks Servicing SMBs

Customer Satisfaction

Deepen customer relationships and strengthen customer retention.

Growth Driver

Expand into a new market

segment, growing portfolio balances and revenue.

Sound Risk Structure

Safety and soundness

scale continuously through multiple levels of protection.

Simple Go-to-Market

Fully compliant program

ready to implement with

no software integration.

Benefits for the Small Business Supplier

Debt-free liquidity to help small businesses eliminate accounts receivable and increase cash flow – just like card merchant services, but designed specifically for B2B transactions.

The TreviPay Small Business Supplier Network enables your SMBs to sell more by:

Drive Low-Risk Growth and Loyalty with your Small Business Customers

Learn how TreviPay helps banks grow their SMB portfolio.

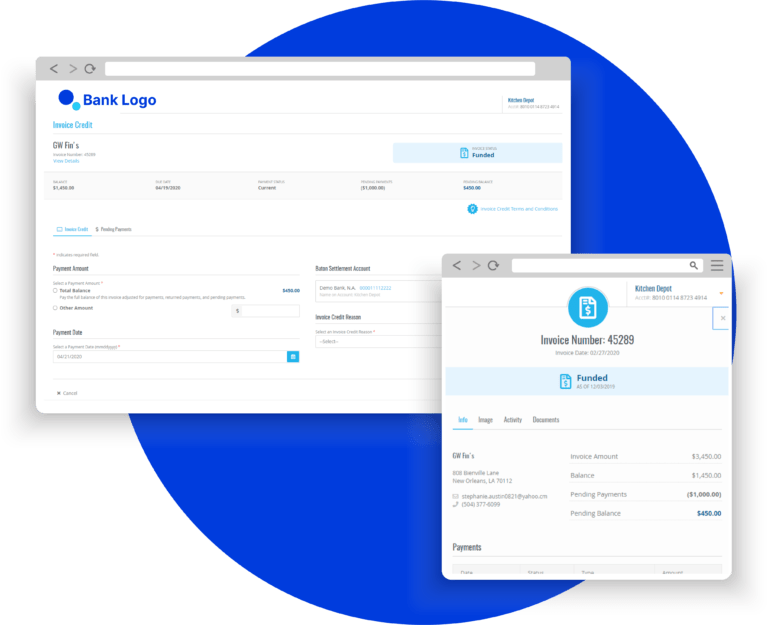

TreviPay & Member Bank Network Roles

Member Banks Control & Customize

the Platform According to their Preferences

Product

Structure

Configure solution features to align with existing customer segment needs.

Risk

Tolerance

Customize risk policies

implemented in TreviPay to manage portfolio exposure.

Pricing

Strategy

Set bank fees in the range of card merchant services (2-6%).

Distribution

Channels

Support go-to-market

strategy inside and outside of the bank.

SMB Success Story:

Dillon Concrete

The SMB was looking for a solution that increased the company’s financial stability, without borrowing. Dillon Brothers Concrete turned to TreviPay for the infrastructure to get paid faster and remove friction from A/R processes.

“TreviPay helps us to be bankable. It helps Dillon Brothers a lot. It strengthens our cash flow. It makes our balance sheet look a lot stronger to the banks that we’re trying to get maybe a loan from to buy equipment or vehicles.”

Larry Dillon

CEO, Dillon Brothers Concrete

Resources for B2B Business Growth

Drive Low-Risk Growth and Loyalty with your Small Business Customers.

Learn how TreviPay helps banks grow their SMB portfolio.