OVERLAND PARK, Kan., December 4, 2024 — TreviPay, the most-trusted B2B payments and invoicing network, today announced it has been named a Major Player in the IDC MarketScape: Worldwide Accounts Receivable Automation Applications for the Enterprise 2024 Vendor Assessment1. TreviPay was one of the 14 vendors with a SaaS or cloud offering to be evaluated for their accounts receivable (A/R) strategy and capabilities.

The IDC MarketScape report highlighted a selection of TreviPay’s strengths including:

- Robust APIs: “The TreviPay suite of APIs enables merchants to directly integrate invoicing into any ecommerce platform, point-of-sale environment, or order management platform. In addition, TreviPay enables a white-labeled solution that may be embedded within the checkout, giving buyers a line of sight into how much credit they have available in real time. Terms to buyer and settlement with client are both independently configurable, enabling guaranteed DSO.”

- Expanding/Expansive Ecosystem: “The most recent investments include a strategic partnership with Mastercard to give suppliers the ability to extend trade credit financing and invoicing using Mastercard’s commercial card payment capabilities. Also, TreviPay recently announced a strategic partnership with Allianz Trade that integrates Allianz Trade’s credit insurance into TreviPay solution for enhanced risk management that enables funding capabilities.”

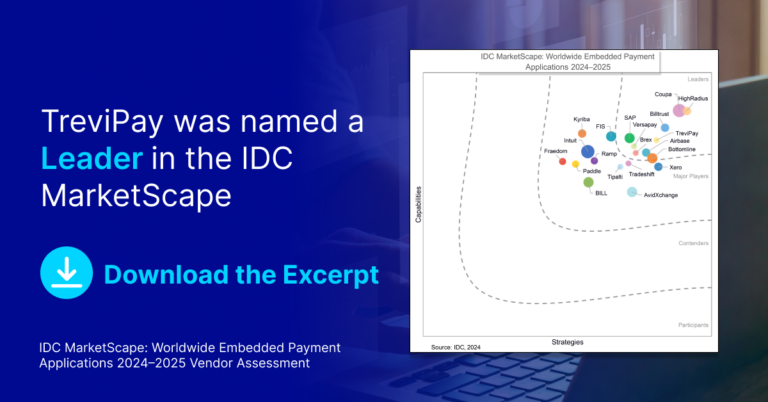

The evaluation assesses vendors in two primary categories: strategies and capabilities. The strategy criteria measure how well the vendor’s future strategy aligns with what customers will require over the next three to five years, and measures functionality roadmap, extensibility, scalability, customer experience and 3rd platform strategy. And the capabilities criteria assess agility, automation, extensibility, flexibility, functionality, portfolio benefits, 3rd platform usage and visibility.

“Traditional accounts receivable processes are ripe for disruption. As we saw in our vendor assessment, this is dynamic market with a range of A/R solutions for the enterprise, but only a few, like TreviPay, that offer an integrated order-to-cash solution along with native financing options,” said Kevin Permenter, senior research director, Financial Applications at IDC.

This recognition follows TreviPay’s recent news to expand its automated order-to-cash offering and further enhance the buyer onboarding experience by reducing manual reviews and speeding up credit decisioning to near real-time. It also comes on the heels of the TreviPay Crossroads conference which brought together clients, partners and industry leaders from across the B2B payments ecosystem.

“We are thrilled to be recognized by IDC MarketScape as a Major Player in Accounts Receivable Automation Applications for the Enterprise report noting our deep payment management functionality, robust APIs and expansive ecosystem as key strengths,” said Brandon Spear, CEO of TreviPay. “As a first-time participant in this evaluation, it is particularly gratifying to see our distinctive capabilities and forward-looking strategies recognized in this assessment. With our focus on working with the largest global brands, we have seen the massive opportunity in automating core A/R processes, offering more payment choice to buyers and providing perfect DSO to financial teams.”

Download an excerpt of the vendor assessment.

##

1 IDC, IDC MarketScape: Worldwide Accounts Receivable Automation Applications for the Enterprise 2024 Vendor Assessment, #US51740924, December 2024

About TreviPay

At TreviPay, we believe loyalty begins at the payment. By understanding the diverse and unique requirements of B2B sellers, TreviPay’s global B2B payments and invoicing network enables enterprises to provide payments choice and convenience, open new markets and automate accounts receivables. With more than four decades of experience, TreviPay serves leaders looking to build loyalty while driving efficiency and embracing new digital channels, especially in industries with large distribution networks such as manufacturing, retail, and transportation. For more information, visit www.trevipay.com.

About IDC MarketScape

IDC MarketScape vendor assessment model is designed to provide an overview of the competitive fitness of technology and service suppliers in a given market.The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s

position within a given market. IDC MarketScape provides a clear framework in which the product and service offerings, capabilities and strategies, and current and future market success factors of IT and telecommunications vendors can be meaningfully compared. The framework also provides technology buyers with a 360-degree assessment of the strengths and weaknesses of current and prospective vendors.