Business-to-business (B2B) collections can be challenging.

If managed well, collections will not only improve your cashflow but also help retain customer relationships.

It can also contribute to building your reputation for being a supportive and professional supplier in your market.

Below is a quick review of best practices for B2B collections, based on our experience and expertise.

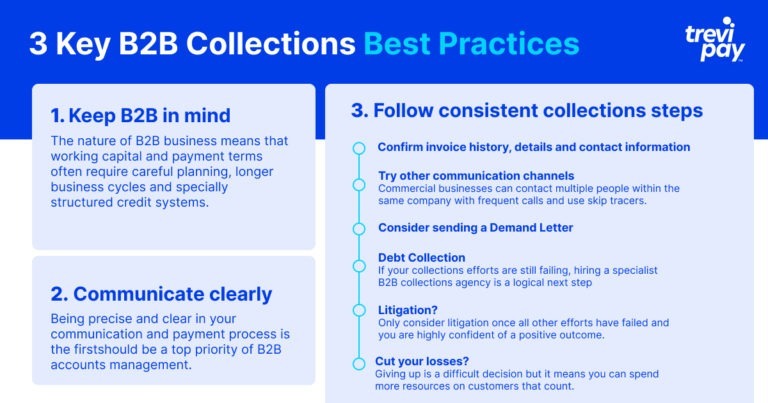

Best practice 1: Keep B2B in mind

B2B clients often require flexible and bespoke payment options to meet their complex business needs. And unlike their business-to-consumer (B2C) counterparts, it can take much more time and effort to acquire and onboard new B2B clients.

Following best practices around accounts receivable will help you maintain a good reputation and retain your B2B relationships.

What is accounts receivable (AR)?

Accounts receivable (AR) is money owed to a business or individual for services or products already supplied.

In theory, this could include an invoice that isn’t immediately paid. In practice, it usually only applies to late payments, late fees or credit extended over more complex or long-term payment plans.

What is accounts receivable management?

Accounts receivable management is the process by which payments owed to a business are managed.

This includes how invoices and other past due accounts are recorded, issued, processed, tracked and followed up.

It also involves other payments issues such as late fees or unforeseen costs related to your service, as well as contacting customers and collecting payments.

Businesses are increasingly choosing to outsource their A/R management, due to cumbersome manual tasks that bog down teams and remove focus from innovation.

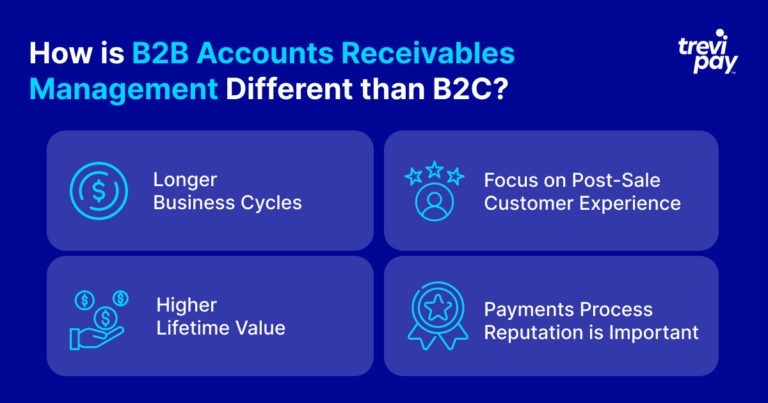

Is B2B accounts management different from B2C accounts receivable management?

The nature of B2B business means that working capital and payment terms often require careful planning, longer business cycles and specially structured credit systems.

Due to these conditions, the lifetime value of a B2B customer is likely to be much higher than a mass market consumer. Meaning, you need to be respectful of the differing needs of B2B clients.

Establishing a sale is one thing, but nurturing and maintaining those customer relationships takes a focus on customer experience from the ‘buy button’ all the way to invoicing and beyond.

The B2B world is small and businesses often talk. If just a few decision-makers negatively perceive your collections policy or payment collections process, you could find your business acquires a reputation for being difficult to do business with.

Best practice 2: Communicate clearly

Clearly communicating your account and payment process should be a top priority of B2B accounts management.

Be precise but explicit in your communications. If important information on due dates, late fees, and the collections process is written in legal jargon in your small print of contracts, it’s likely to be missed.

All payment terms, deadlines and follow-up late payment steps should be clearly listed and available to your customer.

Be sure to mention these details verbally or in other communications early on in the relationship and point to where they can be found. This can even be built into the auto-dunning process.

Best practice 3: Follow consistent collections steps

However, if your client hasn’t paid or responded via the normal communication channels in a timely manner, next steps are in order.

6 steps for best practice accounts receivable collections

1. Basic first questions your business should ask itself

Consider the following checklist early on in your decision-making process:

- Was the invoice sent by and to the correct person?

- Have you tried to contact the business owner directly?

- Was an initial response received?

- Is there a pattern with their past due invoices?

- Is this a particularly busy period for the client’s industry or company?

- Is there an alternative payment plan you can offer them?

2. Other communication channels

In many countries, B2B and commercial communications are regulated differently to B2C.

For example, in the US, the Fair Debt Collection Practices Act (FDCPA) restricts consumer debt collection methods such as repeated calling, calls at work or revealing the information about the debt to third-parties.

However, in the commercial world, businesses can contact multiple people within the same company with frequent calls and use skip tracers.

What is skip tracing?

Skip tracing (also known as debtor tracing) is the tracking down of information on debtors who have “skipped town”.

Using a skip tracers’ service helps collections efforts by doing the time-consuming leg work around research and information gathering needed prior to contacting certain customers.

3. Demand letter

If your standard lines of enquiry are ignored for an extended period, consider sending a demand letter.

What is a demand letter?

Demand letters are documents usually written by lawyers on behalf of the organization. They aim to resolve a payment or other kind of dispute between businesses (breached contract, broken terms, etc.).

Demand letters are simultaneously both the first step towards legal action and an effort to prevent it.

They detail the dispute and create a paper trail that can be used as evidence later, if needed.

How long until you should send a demand letter?

This varies between businesses and the specific relationship with the client. Your future dealings with the client might be impacted if you send it too soon.

As a general best practice, we suggest waiting for a clearly delineated period of time, i.e., 30, 60, or 90 days before sending a demand letter.

4. Debt collection

If your collections efforts are still failing, hiring a specialist B2B collections agency is a logical next step for many businesses.

Many prefer their expertise, as they are more likely to understand the nature of the account and clients involved better than those focused on consumer accounts.

If successful, this route could resolve the dispute and spare you and your customer time in court.

5. Litigation

Only consider going to court once all other efforts have failed and you are highly confident of a positive outcome.

Losing a case could not only be costly, but it could impact other potential clients’ likelihood of using your products or services.

6. Cut your losses?

Hiring a law firm can be expensive and take up precious time. Avoiding the Sunk Cost Fallacy is not easy.

If recovering the debt seems unlikely, internal efforts are consuming too many company resources, or the settlement will be less than your legal costs, it could be time for a business to write off the debt.

Giving up is a difficult decision but it means you can spend more resources on customers that count.

Conclusion

Manging the collections process is an unwanted overhead that drains company resources.

Following our B2B collections best practices can help minimise those efforts.

Clear communication of your terms and alignment with your customers’ processes is essential. Diarised and documented follow ups will help you maintain a professional approach, good relationships and cashflow.

These are crucial because B2B collections are different from consumer collections. There is a relatively small pool of B2B customers and it has unique invoicing and crediting practices.

These points will not only help you deal effectively with collections cases, but will also make them less likely to arise.

Establishing clear parameters and processes is likely to result in rewarding long-term relationships with your customers.