When you discover problems at each stage of your order-to-cash (O2C) process, you know it needs an upgrade. So, you’ve identified what needs to change and are starting to take action.

You know you need to focus on scale and quality at each phase because, without it, issues can snowball. Some of the challenges you might be navigating:

- Aging A/R increasing your days sales outstanding (DSO)

- Increasing bad debt

- Growing customer complaints from lengthy processes and errors

- Rising expenses from adding headcount to keep up with the work

- eInvoicing is becoming more challenging with complicated requirements

- Salespeople are too focused on A/R activities

- More time, energy and resources are going into correcting mistakes and follow-up from missing or misapplied payments

For an overview of the potential problems that can arise in your O2C process and the first steps to take, read 7 Signs Your O2C Process Needs an Upgrade — and What To Do Next.

Collections is an essential — and quite tricky part of the O2C process.

When done correctly, there’s little to no friction with your customers, and you maximize their ability to spend more with you with their open-to-buy credit available. The inverse is also true — when done incorrectly, you could ultimately lose customers and revenue.

It’s important to note that for B2B customers, the majority of payment friction isn’t a result of their inability to pay due to financial issues. A missed business requirement could be preventing your customer from paying. Many times, customers can’t settle invoices due to missing or incorrect purchase order numbers or a discrepancy on the invoice. TreviPay has many mitigating controls in our upstream processes that prevent these challenges when possible.

Once you mitigate several of those difficulties, the challenge becomes one of effective scalability. As you successfully onboard more business customers, the collections workload can wind up overwhelming your team. And it won’t take long to realize that quality needs to be the focus of scaling if you’re going to do it well.

This article will highlight the complexities you may encounter as you embark on the journey of scaling your O2C processes. Collections involve a delicate dance of determining what is too much or not enough communication, outreach too early or too late and with precision, all while sustaining a positive customer experience. The first step in this journey is to really understand your portfolio and different customer segments. Then, you can outline your collections framework and finally execute, measure and evolve your process.

Step 1: Portfolio Stratification

Understanding your existing portfolio is important because not all customers are equal, and collection processes should vary. If time and money were not an issue, personal outreach to customers would be the standard collection approach. But the hard truth is that scaling with quality is only possible by stratifying your portfolio into tiers and varying collection activities by customer tier.

You can base stratification decisions on many different criteria. When thinking about the customer experience, these measures could be drivers:

- A customer’s size, as determined by credit limit or annual spend

- A customer’s potential size, based on a strategic relationship

It’s equally important to think about your internal risks, so some of these benchmarks could be drivers:

- Customers with longer DSO

- Customers who are startups or have been in business for only a couple of years

- A customer’s risk rating that is either fed from an external data source or calculated internally

- New customers without a known history

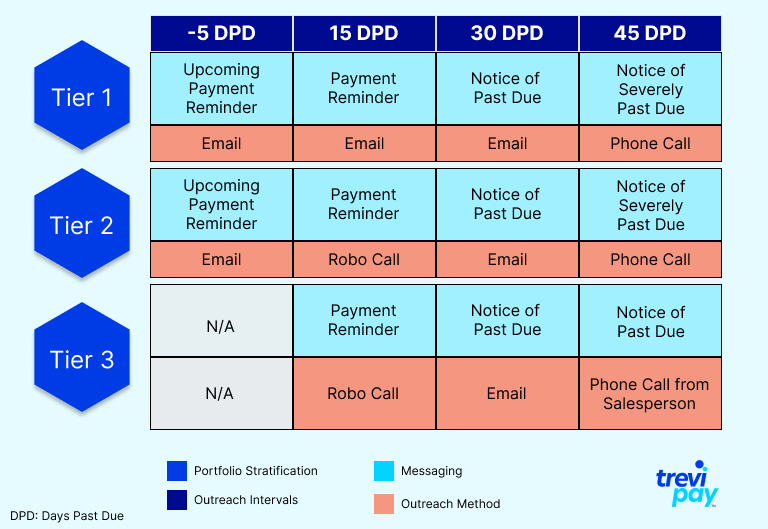

With tiers in place, you’ll have defined criteria for appropriately handling customers within each tier. The requirements that trigger an outreach can be different, as can the timing, messaging and communication method. Our years of experience have shown us that even with automation, the number of tiers and the outreach variables can grow exponentially, making them prone to more errors. Without automation, this exacerbates scaling challenges.

Step 2: Define the Collection Framework

Your framework should include four components: Data Integrity, Criteria, Outreach Intervals and Messaging and Outreach Methods.

1) Data Integrity

The most important part of your collection framework is having accurate, real-time data. Data is the foundation for which you’ll build your entire collections process. Since all O2C systems are interconnected, errors in your data will negatively affect the whole process.

For example, a moment-in-time payment snapshot should be able to accurately display payment status and any promises made by the customer. Any missed data points here could result in unwarranted outreach or uninformed communication, resulting in negative customer reactions.

2) Criteria

The criteria will determine when to set the collection process in motion for an account and can vary by portfolio tier. The most common criteria are:

- The due date, which could trigger a reminder of an upcoming due date or a reminder of a past due amount

- Customer tier

- Amount past due

Calculating the amount past due isn’t always straightforward and relies heavily on the data accuracy and timeliness outlined above. Here are some typical factors that you may want to take into account:

- Disputes

- Unapplied funds

- Promises to pay

Depending on the complexity of your business, you might have more criteria to consider, and these criteria will most likely become more sophisticated as the process evolves over time and as you uncover portfolio nuances.

3) Outreach Intervals & Messaging

Outreach intervals include the timing and frequency of your communication, such as when it’s too soon vs. too late and what’s too often vs. too infrequent. The appropriate interval will take time to fine-tune for each portfolio tier. As you work to find the proper balance of message timing and frequency, quality still needs to be at the top of your mind here to deliver an excellent customer experience.

Messaging should also vary for each interaction. As mentioned above, customers may not be struggling to pay you for financial reasons. They may need additional information to meet their business requirements to pay the invoice. Initial notices should include friendly payment reminders and tips on resolving any issues with the invoices preventing payment. As the collections process progresses through the intervals, the messaging shifts to further communicate the urgency of action. In all messaging, ensure the customers have clear paths to get support with any issues they need assistance with.

4) Outreach Methods

Outreach methods require a careful approach. In a perfect world, you could always pick up the phone and talk to your customer. But as your B2B portfolio continues to grow, this becomes nearly impossible and can even lead to an unfavorable customer experience. Imagine you had a delay in connecting with a customer, then their account goes past due, and as a result, they run out of credit. From our experience, personal outreach as a part of any collections framework supports customer loyalty. To scale while maintaining quality, the timing and frequency will need to vary by customer tier.

Some of the outreach methods include:

- Emails

- Phone calls

- Robo-calls

- Conference calls

- Escalation through a salesperson

This Collection Framework becomes the basis for communicating and executing your Standard Operating Procedure (SOP). Here’s an example of what a Collections Framework might look like:

Step 3: Execute, Measure and Evolve

Now, it’s time to implement your Collections Framework. Ideally, you can automate the execution by triggering the outreach based on the framework’s criteria, interval, messaging and method. Once your automation is fully operational, templated emails go out automatically, and tasks are added to work queues to trigger calls to customers.

It’s important to track measurements on both quality and scale. From a quality perspective, what’s the voice of the customer (VOC) telling you?

- Do you need to contact them less frequently?

- Are the messages resonating with them?

- From a quality perspective, are you seeing improvements in your DSO?

- Can customers maximize their ability to spend more with more open-to-buy credit available?

These measurements will be the basis for your framework’s evolution. You should be able to use the feedback you receive to tweak your framework to improve quality and scale as you grow. Remember that your framework’s development is an ongoing process that needs to evolve with your customers, market changes and automation tools.

Additional Considerations for Geographies

The geographical component is another factor to consider in all three of these steps. The jurisdictions where you operate also have implications for the collections process.

You’ll also want to consider:

- Varying legal requirements by country or even by state in the US, so keep current with the latest laws.

- Cultural differences can influence your outreach methods — and in some countries, a face-to-face visit is crucial.

- Not only do the collection notices need to be geographically specific with translations and currencies, but the terminology may also vary.

Successfully Scale Your Business With Quality

This article has outlined many of the complexities of this function within the O2C process, but it only scratches the surface of what it really takes to successfully build a collections process that scales with your business and with quality. The process’s iterations are endless, and the automation tools need to advance with the latest technologies.

At TreviPay, we have years of maturity around this process and have learned many key lessons. If you’re embarking on this journey, prepare to put in the work. The tipping point for optimized scale and quality is 3 to 4 years out, depending on your particular portfolio and growth projections.

Some companies spend years trying to automate collections on their own. Why not work with a partner experienced in optimizing complex collections processes like TreviPay?

Read our new guide “6 Ways to Bring Order to Your Order-to-Cash”