Let’s face it, businesses are in business to market their product or service, and a great way to increase sales is to sell those products or services to other businesses (B2B). When selling B2B, before you know it, you’re determining how to set up and run an order-to-cash (O2C) process that enables you to invoice and collect from other businesses — your customers. But business buyers are complicated, and since B2B O2C isn’t your company’s core competency, you may realize at some point that these processes aren’t functioning optimally, ultimately negatively affecting your buyer’s experience.

An efficient O2C process that provides the best customer experience is essential for any company, regardless of size or scale.

With growth in your B2B sales channel, your O2C process becomes even more critical. By effectively managing and optimizing specific stages of this process, you can improve the customer experience, cut costs, eliminate inefficiencies, and ensure timely payment for your products and services. When the process removes friction for your customers, they’ll love doing business with you and become more loyal.

This process is particularly vital for the success of your digital transformation efforts, especially if you’re looking to expand and grow. No matter where you are in this journey, whether you have processes today that aren’t optimal or are embarking on a B2B sales expansion, this blog will help highlight considerations, pitfalls, and solutions you want to consider.

We’ve helped companies at every stage of their digital transformation journey. In this article, we’ll also explore the signs your O2C process needs support and what you can do about it

7 Common Signs You’re Not Maximizing Your O2C Process:

- Aging A/R: which is increasing your DSO

- Increasing Bad Debt: trending in the wrong direction

- Rising Customer Complaints: things take too long or are done with errors

- Increasing Expenses: you need to keep adding people to keep up with the work your B2B growth brings

- eInvoicing Complexity: more and more customers need it, and it’s becoming more challenging to adhere to their unique requirements

- A/R Activities Consume Your Salespeople’s Time: they’re missing key sales opportunities

- Missing or Misapplied Payments: more time, energy, and resources are going into correcting mistakes and follow-up

When businesses contact us, one or more of these problems are present. Since many of these O2C issues are connected, ignoring one can quickly manifest into more complicated problems.

If you can relate to one or more of these signs, it’s time to rethink your approach to your B2B O2C process. You may even be at a crossroads, wondering if you can upgrade these processes in-house or if you need a partner’s assistance.

At TreviPay, B2B O2C is our core competency, so whether you choose us as a partner or decide to revamp your processes yourself, I would like to provide insights based on our years of experience in this space.

The Importance of Focusing on Scale and Quality when Optimizing the O2C Process

As you embark on this journey, keeping scale and quality as your guiding principles is key. Automation, for the sake of automation, will lead to more problems if it doesn’t stay focused on quality. When you’re looking to improve internal efficiencies for scale, here’s the most important question to start with — what does our customer or employee experience look like when this automation is done correctly?

Most businesses begin with scale and try to fix the little things, usually one at a time, as they grow. Scaling is key to supporting your B2B growth strategy in the most profitable manner. Without scale, companies find the B2B profits evaporating into the highly manual processes and additional capital outlays.

A quality customer experience and employee satisfaction are equally meaningful and should be addressed in parallel with scaling. The customer experience and employee satisfaction will improve when quality and scale work together.

Although there are several functions within the O2C process, these are the four that often present the toughest hurdles you’ll experience as you contemplate a make-or-buy decision as you scale with quality:

- Customer Risk Management

- eInvoicing

- Collections

- Cash Application

Optimizing these functions can have a positive impact on addressing the seven signs that your O2C is not optimized. Yet it should be known that enhancing these functions will be complicated, take a considerable amount of time and need continual improvement as your customers’ expectations change over time.

Customer Risk Management

Customer Risk Management begins when a new business buyer wants to become a customer and continues throughout the customer’s lifetime. This function includes customer application, underwriting and ongoing risk management. When approached with scale and quality, you can maximize the customer’s spending potential while limiting exposure to bad debt.

eInvoicing

Customers may request to receive their invoices directly into their ERP system or custom portal. eInvoicing involves using several different methods to automate and optimize invoice delivery to meet your customer’s needs. When approached with scale and quality, you reduce customer friction, A/R aging improves and customer spending and loyalty often increase.

Collections

A customer-friendly and efficient collections function is vital to a healthy O2C process. When approached with scale and quality, customers receive the necessary notifications at the right times and with the correct outreach method. Once optimized, the function isn’t burdensome for the customer, and payments are received timely.

Cash Application

Customers typically prefer to release payments for specific invoices, so applying cash according to their instructions creates the best customer experience. When approached with scale and quality, this process runs timely with very little human intervention.

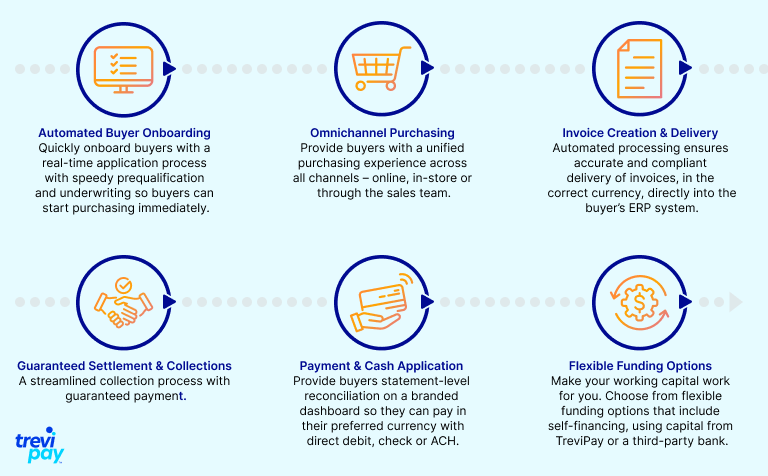

When scale and quality are addressed simultaneously and done right, this is what your efficient O2C process looks like:

- A/R aging doesn’t exceed 60 days past due

- Minimal bad debt

- Delighted and loyal customers

- Expenses scale more profitably with growth

- Invoices are delivered when and how the buyer wants them

- Salespeople focus on sales opportunities

- Payments are received timely and properly reflected on the customer’s account

Overcoming the complexities of the O2C process — customer experience, operational inefficiency, risk management, integration challenges and growing payment reconciliation requires integrated and harmonious solutions that can support multiple digital payment methods. This is why many companies seek a partner with experience overcoming these complexities — like TreviPay. Instead of spending years trying to do this on your own, why not rely on an expert who understands the complexity of B2B customers and keeps optimizing and evolving with them?

Read our new guide “6 Ways to Bring Order to Your Order-to-Cash”