Dunning helps businesses initiate collections and recover lost revenue.

How dunning is handled can influence how smoothly operations – and relationships – proceed thereafter.

By better understanding dunning, you can implement practices and strategies that should result in the most positive long-term outcome for your business.

What is dunning?

Dunning is the communication and interaction process used for pursuing unpaid accounts receivable (i.e., unpaid invoices).

Early on it usually involves polite email or telephone reminders. Later stages may require direct face-to-face demands or legal action.

The order and details of each step may vary depending on the specifics of the case – including the amount owed and the nature of customer interactions, for example.

Dunning may be needed for a variety or reasons. A customer may be unable to pay at that time, a transaction error may have occurred or they possibly just forgot.

Why is it called ‘dunning’?

The word ‘dun‘ originates in 17th century England, where it meant ‘to demand repayment of a debt.’

A perhaps apocryphal story suggests it may have derived from the name of an enthusiastic bailiff named Joe Dun.

Merriam-Webster also lists it as a verb meaning ‘to plague, pester’. A strong hint of the negative associations of its origins…

How the dunning process works

The dunning process refers to the specific steps and their sequence taken to communicate with a client that is in arrears.

This might be done in-house by the relevant department (for example, the accounts receivable team) or by a specialist third-party agency.

Because each industry, customer and situation is different, the dunning process is unlikely to be the same for every business.

The precise steps taken may also vary between countries. For example, visiting a business’ location may be legally classified as harassment in one country but not in another.

However, one general principle is likely to be universal: each stage of the dunning process will likely express an escalation in the urgency for need of repayment.

Dunning examples

Let’s put this in practical terms.

Client A and Client B both have unpaid and overdue invoices. Client A fails to respond to an initial email request for payment. Client B, however, apologises soon after upon the communication and requests more time.

In each scenario, the follow-up to the initial dunning email will likely be markedly different. This difference might be both in tone and possibly medium. Client A might be called to establish whether they received the email; Client B might only need a confirmatory follow-up email.

What is a dunning email?

A dunning email is simply an email sent as part of the dunning process. Email is the most common type of dunning method used early in the process.

This is because it is the simplest and easiest way to clearly pass on recorded information about the related collection.

What does dunning level mean?

‘Dunning level’ is a phrase used by some CRM software solutions to describe the messaging used in automated dunning outreach.

The higher the dunning level, the more serious the situation. This is reflected in the tone of the correspondence.

Defining and refining these levels depends on the source of data available to the business. Early on, intuition may lead decisions. Later, the types of outreach that best elicit payment should become clear.

What is a dunning fee?

A dunning fee (or dunning charge) is the charge or fine that a business might apply to a client account at certain stages of dunning escalation.

It needs to be stipulated clearly in payment terms – and ideally other communications – early on in the business relationship.

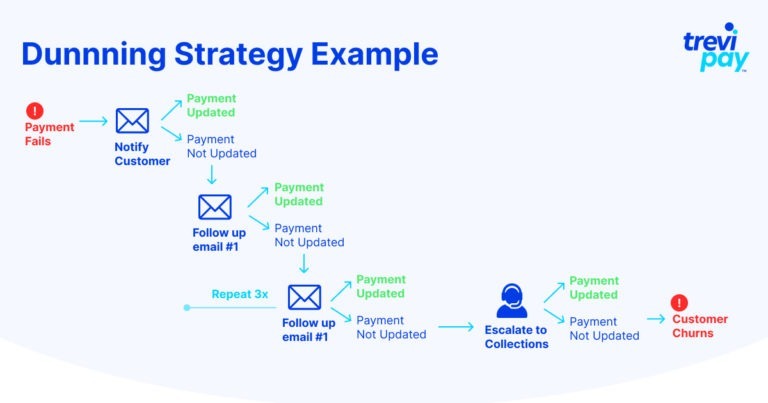

Dunning strategy

Good dunning strategy requires striking a balance between being polite enough to maintain a good relationship with customers and firm and persistent enough to push them towards paying sooner. To enhance your approach, consider integrating effective B2B collection strategies that can improve the success rate of your dunning efforts.

Subjective judgement may play a role in many stages of the process and in individual cases. Larger businesses often use automated dunning processes. This demands getting the messaging right from the outset.

Giving the benefit of the doubt should be standard dunning practice, especially early on.

If initial communications fail to elicit payment or even a response, the next step might involve using an external collections agency to escalate the process.

This is in itself a double-edged strategic decision – it might increase the likelihood of recovering debt but also of severing relations with customers.

What if dunning doesn’t work?

Dunning is often unsuccessful. When it is, what should you do next? Below are the three possible options.

1. Cutting losses

You might choose to forfeit payments rather than escalate dunning beyond the early stages.

This could be because your industry or niche has a relatively small target market in which you don’t want to risk potential reputational damage (from option 3). Or simply because the payments owed aren’t worth the resources needed to pursue them.

2. Negotiate new payment terms

Customers’ might not be replying to your dunning because of their uncertainty about how they will pay you back.

Perhaps they have a problem with cashflow and are already considering solutions such as receivables financing and invoice factoring.

For current outstanding payments, offering to negotiate new payment terms may give your client some breathing space. This could be your best option to recover the money owed and increase the chance of resuming your working relationship.

As a way of ensuring that financial issues such as these do not arise with your clients in the future, you can consider offering them a line of trade credit. This will help them manage their cashflow. Long-term, this could increase your sales volume with them and create a win-win situation for both parties.

3. Legal action

Legal action is a last resort that can ultimately see your money recovered. Whether it is worth pursing depends on two factors: the legal costs (in terms of money and resources – including time) and reputational risk.

Conclusion

Dunning is the initiation and processes relating to collections. The best possible outcome is that it recovers lost revenue whilst maintaining good customer relations.

It covers a range of approaches to clients – at least some of whom may make communication difficult. Getting your dunning messaging and strategy right will help you maximise your success in this area.

Define your payment terms clearly and include any dunning charges you may apply. Automated dunning processes can be very useful, but occasionally human intuition should be used to deal with late payments on a case-by-case basis.

If dunning fails, cutting losses, renegotiating payment terms or even legal action are the last remaining practical options. But with the right initial payment terms and dunning strategy, the chances of this situation arising will be significantly slimmer.