Only a few years ago, the word “automation” used to carry cynical perceptions. Sure, we knew automation would disrupt industries and lead to new challenges. But automation has since shifted the way we work, especially in how we approach business operations. While technology is always exciting, there’s never been a better time to stay curious about how automation is no longer something to approach carefully, but a hero for how we perform essential tasks.

Organizations will always seek ways to provide consistent value while lowering costs, boosting efficiencies, and improving employee and customer satisfaction. We especially see these automations creating greater efficiencies in customer service and administrative duties and taking on those repetitive tasks.

Automation is reducing inefficiencies, redundancies and monotonous work.

From routine administrative tasks to complex decision-making processes, automation streamlines operations and boosts efficiency. Now, we can expect tasks to take less time to complete, improving business operations with artificial intelligence (AI), robotics, optimized logistics and workflow automation. The results are a faster flow of goods and decreased costs.

Businesses looking to grow by scaling processes while maintaining (and even improving) quality know automation is non-negotiable.

In operations, I’m excited to explore where productivity and sustainable automation are critical drivers of success.

Intelligent automation (IA) uses robotic process automation (RPA), artificial intelligence and machine learning (ML) to automate end-to-end business processes.

When most companies begin to adopt RPA, they tend to tread cautiously and take small, simple steps.

Understandable. But where can this approach go wrong?

TreviPay began its journey with RPA in 2018. It started with simple processes and progressively advanced in complexity and sophistication. This approach enabled TreviPay to establish a robust base and slowly broaden its capacity to deal with the varied and complex tasks it oversees today.

Researchers expect the global RPA market to grow to more than $13 billion by 2030, an increase of more than $12 billion compared to 2020. Statista.

RPA — What It Is

RPA is a type of business process automation based on software robots or bots that eliminate repetitive mundane tasks to expedite enterprise operations and lower costs.

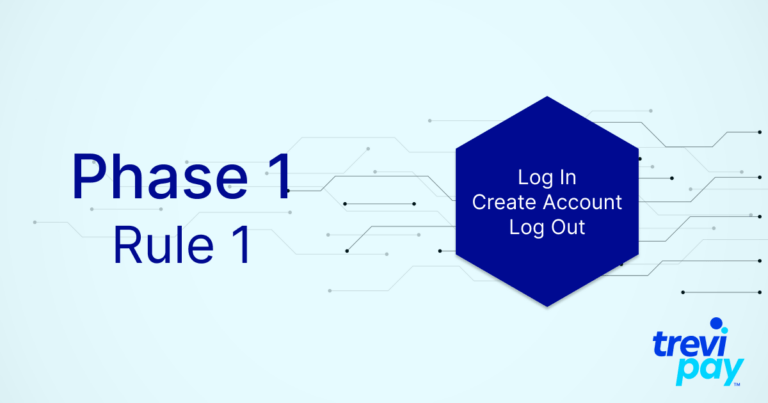

Typically, a company will decide they need a robot to complete a simple process. Say, to create 50 buyer accounts. This is phase one.

Phase 1: Crawl – Script Process as a Single End-to-End Function

Our team gives the bot a spreadsheet and creates some rules — log in, create account and log out. The bot will do this 49 more times to create 50 accounts.

And it works — it’s fantastic. The bot is crawling and creating accounts on its own. In seconds, we’ve helped alleviate a typically repetitive task, effectively freeing up our team members’ time to work on more meaningful contributions.

With our new bot in place, we decide we want it to be able to update accounts, too. So now we have a second bot process that logs in, updates accounts and then logs out. We’re still in the crawling phase and there’s already definite value demonstrated here. Bots alleviate high-volume, rule-based, repetitive and often monotonous work.

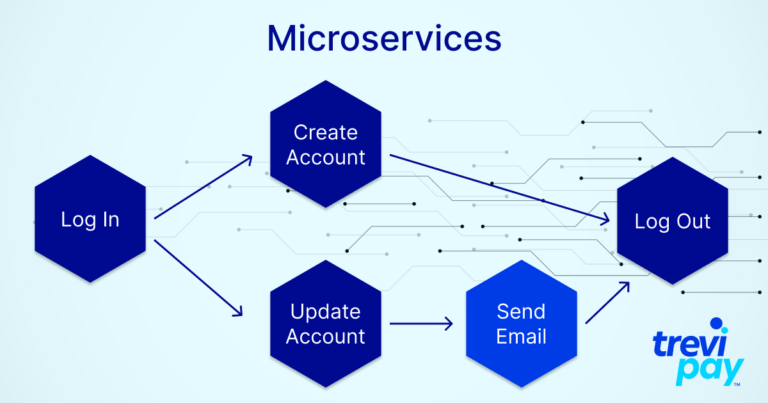

Once we had a handful of bots crawling along smoothly, we add individual microservices.

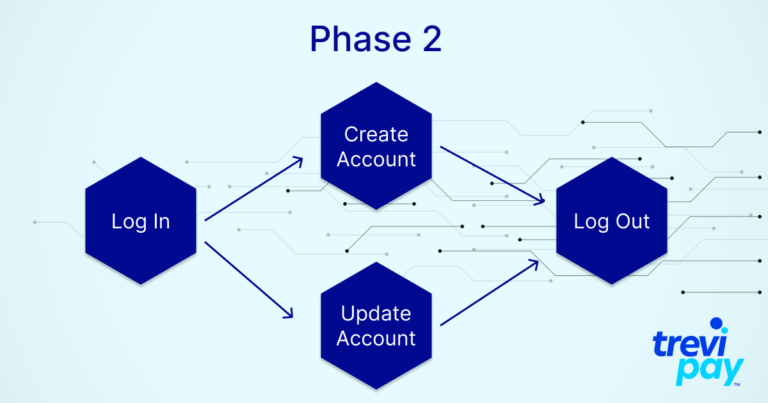

Phase 2: Walk – Script Processes as Individual Microservices

In the second phase of our journey to the all-out run — we walk. We realized if we built each RPA end-to-end and the login script ever changed, we would have to change every bot function because every task begins with a login.

So we got smart, and we started building microservices. In the example above, we now have four microservices. Log in, create an account or update the account and log out.

Now, the bot would log into the system and then call a different microservice that would update these accounts and it activates the appropriate microservices bot for the task. This layout made adding additional steps simple, like sending an email after completing the account update.

Now it’s easy to add additional microservices to a process.

But what’s possible when you skip the crawl-walk-run approach and go straight from crawling to running?

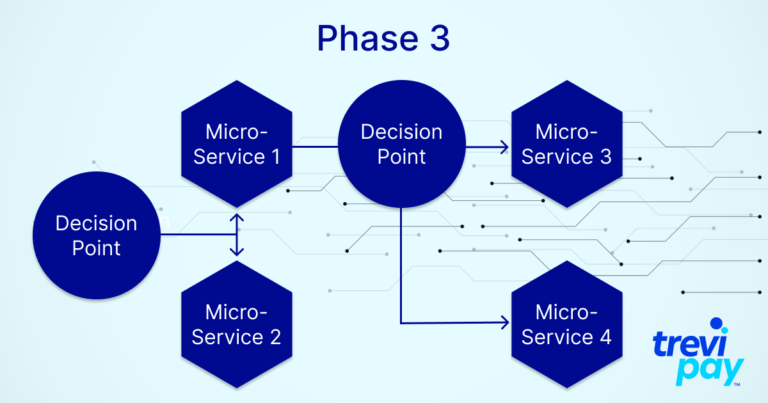

Next, our run phase is a combination of sophisticated workflows where we incorporate the bot microservices.

TreviPay has expanded our number of bots exponentially since the days of crawling. Today, they work 24 hours a day, 7 days a week, 365 days a year.

Theoretically if you have 25 bots working around the clock, they could achieve the work of more than 75 full-time employees.

Phase 3: Run – Sophisticated Workflows Incorporating Microservices

If we still needed to go through the evolution of walking and still doing the basics, that would be fine, but now we can solve complex business problems. We can run.

Because we’ve taken a thoughtful approach to RPA, our bots are intelligent now. They know what they can and can’t do. If a bot can’t complete a task, it puts the work into the queue for a person who can.

When you partner with a B2B payments company, you want the benefit of their run approach.

Because we perfected this process, we can do this at scale while maintaining quality and effectively keeping costs down for our partners.

You could attempt to do this process on your own, which could take several years. But you likely want to get value out of RPA immediately. You’ll save money, time and resources because we’ve been achieving these efficiencies and optimizing how they work together for several years.

Learn how to use RPA to maximize your O2C ecosystem in “Key Trends and Predictions for B2B Payments in 2024”