Global trade has always presented opportunities.

Today, 11 billion tons of goods are shipped each year. This amounts to an average of 1.5 tons per person.

And since 1995, the market for international trade has grown by an average of 4 – 6% every year.

However, there have always been challenges. Even with today’s sophisticated payment systems, buying and selling across borders can be difficult to set up and maintain.

Let’s look closer at B2B cross-border payments and how they work.

What are B2B cross-border payments?

Business-to-business (B2B) cross-border payments are transactions between businesses that work primarily with other businesses across economic zones. These economic zones are typically different countries. But this is not always the case.

For example, a transaction between a manufacturer in Italy and a wholesaler in Germany will take place between countries but within the European Union’s single economic zone.

So, while this is technically a B2B international payment across a border, in practice it is very different to other kinds of payments that cross borders.

B2B vs B2C cross-border payments

B2B and business-to-consumer (B2C) fields have some general differences when it comes to payments. These include:

- Payment methods

- Delivery times

- Invoicing

- Net terms

- Regulations and tariffs

In all of these areas, payments that travel across borders add a new layer of complexity to transactions in both B2B and B2C scenarios. And there is both overlap in how this added complexity manifests.

For example, high-value shipments are scrutinized by customs and financial institutions more than lower-value ones. This naturally leads to more paperwork requirements and delivery delays for B2B sales.

However, the B2B eCommerce market is growing, so customer demand is pushing B2B companies to provide faster, simpler payment journeys.

How do cross-border payments work?

The most straightforward scenario for a cross-border payment (whether for B2B or B2C) is for a low-value payment from a buyer to a seller using the same bank.

The bank can manage the currency conversion and account transfer internally, which should keep the fees and processing time low.

A pre-existing direct relationship between different banks across zones can also streamline transactions. Payment can be credited to the appropriate account and then settled quickly between the banks.

Other payments involve correspondent banking. This is when intermediary banks (correspondent banks) help banks process and settle payments across economic zones. They hold special accounts for both banks based outside of their own economic zone and ones within it. (These are known as nostro accounts to both the foreign and domestic banks, and vostro accounts to the correspondent bank that holds them). With these accounts, each business can settle cross-border transactions with correspondent banks separately.

There might be a ‘payment corridor’ (an intermediary or series of intermediaries) corresponding to banks processing transactions. The longer the payment corridor (i.e., the more intermediaries), the longer transactions take to settle.

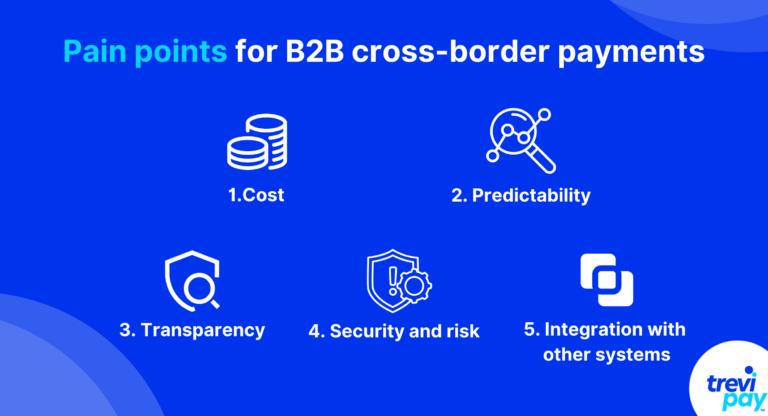

Pain points for B2B cross-border payments

Below is a list of pain points for cross-border payments in B2B. They are not listed in any particular order of importance, as they might have a different impact on different industries or companies.

1. Cost

Cross-border payments can carry additional costs, especially for B2B companies that deal in high-value transactions. These costs are often related to:

- Foreign exchange (FX)

- Transaction fees (including correspondent banks fees)

- Compliance fees

- Shipping

- Tariffs and taxes

Researching and handling these costs alone can take up resources.

The risk is also associated with accepting payments from other jurisdictions, which may impact insurance and payment processing fees.

2. Predictability

The cost and timing of cross-border payments are not always predictable.

Levels of predictability vary between economic zones. Frequently crossed economic borders generally have the most efficient and cost-effective payment infrastructure and channels.

And predictability matters more in B2B than it does in B2C for several reasons, including:

- The high-value transactions involved

- The importance of supply chains

- The order-to-cash (O2C) process

- The frequent use of trade credit, net terms, and other B2B-specific financing solutions (and their impact on cash flow ).

3. Transparency

Transparency applies to cross-border payments in two main ways.

The first way is to track payments. Opaque payment journeys cause uncertainty and delays in businesses’ processes.

The second way is with cost. Many cross-border payments include hidden fees. For example, they may charge high foreign exchange rates, but not highlight this to the customer.

4. Security and risk

A lack of both predictability and transparency can help fraud thrive across cross-border payments.

Juniper Research has estimated that globally cross-border payment fraud losses will reach $46.1 billion USD by 2027. This represents a 57% increase from 2022.

The nature of B2B transactions makes them even more vulnerable to fraud than B2C.

Their relatively high value makes them a bigger target and their complex nature provides more entry points for fraud. And the payment terms used in them give perpetrators more time to vanish before detection.

5. Integration with other systems

Integration between different software solutions can be more difficult when dealing with cross-border payments. This applies to software linked to accounting, invoicing, and more.

For example, there might be different fields or formats required for invoices or even just business addresses in different zones. Or there could even simply be language barriers that make things more complex.

Types of B2B cross-border payment methods

B2B payment trends change over time and according to industry and location. For example, corporate cards are a more popular B2B payment method in the U.S. than in Europe.

Below is a list of the main methods.

1. Bank transfers

Bank transfers are one of the most common B2B payment methods. They include a few different kinds, including wire transfers, automated clearing house (ACH) and direct debit transfers.

It is one of the fastest and most reliable forms of payment. It can also manage high-value transactions, which is useful for B2B payments.

However, bank transfers are sometimes expensive because of the fees and can be slower than some of the new solutions offered by specialist fintechs.

2. Debit and credit card payments

Debit and credit card payments are among the most convenient payment methods available to consumers and businesses.

Like regular bank transfers, this method automatically process currency exchanges. This is done by card networks and acquiring banks, which means buyers have to accept their providers’ rates.

3. Digital wallets

Digital wallets (often also known as eWallets) function similarly to debit and credit cards. The main difference is digital wallets allow users to make transactions in different currencies. This reduces their costs.

4. Checks

According to the latest data, $8.9 trillion is spent using checks for commercial transactions within the U.S. annually.

The benefits of using checks for sellers include their low costs, their suitability for record-keeping and the period of time they buy for businesses making payments (unlike immediate electronic equivalents).

However, checks aren’t always reliable for cross-border payments. They include security risks and slow processing times.

5. Alternative payments

There are a wide range of alternative payment methods available at present. This broad category includes crypto, biometric payments and wearable payment systems.

This methods is reshaping the global financial landscape, enhancing financial inclusion, convenience, security and innovation.

And projections indicate that their market value will likely surpass $15 million by 2027. This demonstrates a compound annual growth rate (CAGR) of 16.3% from 2017 to 2027.

Offering B2B cross-border payments

Offering B2B cross-border payments enables businesses to expand globally and access buyers from new markets, which can increase and diversify sales.

However, it can increase risk and costs, too. Directly setting up the payments infrastructure to process them involves overcoming multiple technological and regulatory hurdles.

One way businesses can bypass these difficulties is to partner with a specialist B2B payments provider.

The importance of embedding B2B payments

Embedding (integrating them into your existing channels and platforms) B2B payments increases their adoption rate.

This is an essential feature for businesses looking to compete online. Without it, businesses’ cart abandonment rates will remain high – after all, their customers will only ever be a few clicks away from their competitors.

TreviPay’s cross-border payments solutions

Our focus on B2B retail is designed to improve global B2B payments by offering a uniform, global payments, financing and invoicing system. We can help retailers reduce risk, increase sales and improve loyalty.

Cross-border opportunities

Global trade brings growth opportunities. However, crossing borders often brings challenges for B2B transactions.

The logistics of helping high-value goods travel across economic borders might even seem simple compared to the challenges of payment processing.

Pain points for B2B cross-border payments can cause delays and uncertainty. These include unpredictable costs, hidden fees, complex integrations and security risks. These are not helpful for business.

By embracing embedded B2B payments, businesses can seamlessly integrate international transactions into existing platforms and unlock access to new markets.

Ready to offer cross-border paymetns and expand globally? Explore 7 Important B2B Payment Considerations and prepare your business for successful global expansion today.