Some B2B merchants are hesitant to move even part of their business online.

The idea of disrupting an existing working business model is daunting. And new opportunities are often overshadowed by new challenges.

But online sales are increasingly essential for B2B. And a delayed or substandard entry into the field could prove fatal for your business.

Let’s explore the B2B eCommerce landscape in more depth.

What is B2B eCommerce?

Business-to-business (B2B) eCommerce is the online buying and selling of goods and services between businesses.

The B2B category includes wholesalers, manufacturers, and many other kinds of businesses. It cuts across multiple industries and different-sized companies.

B2B eCommerce can take place directly on a company’s own website or app, or on third-party B2B marketplace platforms. And it can be either a primary or secondary online sales channel.

B2B vs B2C eCommerce

Differences

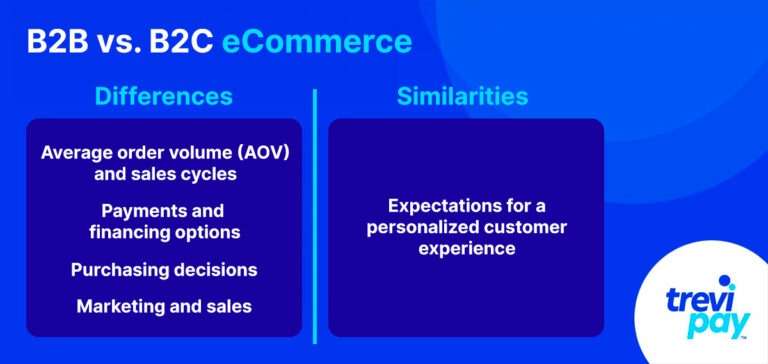

Broadly speaking, the main differences between B2B and B2C eCommerce come down to several main points.

As with pre-online selling days, B2B and B2C sales usually take place on different channels and platforms. Amazon and Amazon Business, for example, are separate online marketplaces.

Average order volume (AOV) and sales cycles are also different. B2B purchases are larger and often have a more fixed sales cycle than B2C ones, which can create challenges for suppliers.

Purchase decisions also vary. B2C purchases are usually straightforward, whereas B2B sales often require sign-off by multiple decision-makers.

Marketing and sales can vary because of different organizational structures and strategies. In many B2B companies, the sales process leads to marketing efforts.

Payments (see below, ‘B2B payments’) and financing options (see below, ‘eCommerce financing options’) also vary.

Similarities

There are many similarities between both categories of eCommerce, too. Perhaps the primary one is: the customer.

After all, practically all B2B buyers are also B2C buyers in their spare time. So, many customer expectations of B2B eCommerce are influenced directly by the B2C eCommerce model.

For example, an increasing number of business buyers favor a more personalized customer experience.

Today’s B2B eCommerce landscape

B2B sellers are increasingly entering into the digital marketplace, either with their own online platform or third-party eCommerce tools.

According to one report, US sales transactions through B2B eCommerce sites reached 14.86 trillion USD back in 2022— up 14.5% from the year before.

A paper by Forrester Research states that 74% of B2B buyers believe that buying from a website is more convenient than buying from sales reps. And 93% prefer to buy online once they have already decided what to buy.

And research by TrustRadius found that 87% of B2B buyers want to use self-service portals for part or all of their buyer journey. Perhaps this comes as no surprise when you factor in that the largest group (60%) of B2B tech buyers are millennials.

Most B2B businesses now offer B2B eCommerce

It’s estimated that approximately 2/3s of B2B businesses have an eCommerce platform. And B2B eCommerce sales make up approximately 13% of all B2B revenue.

The future of B2B eCommerce is bright…

One estimate for the projected compound annual growth rate (CAGR) of the global B2B eCommerce market is 20.2%.

This likely reflects broader global digital transformation. The world has an estimated 5 billion internet users who spend on average nearly 7 hours online a day.

The retail eCommerce market looks set to grow, too. It’s estimated to reach 8.1 trillion USD in 2026, a huge growth from 6.3 trillion USD in 2023.

In short, if you are looking to create or grow your eCommerce sales, there’s no time like the present.

Types of B2B eCommerce

There are two main categories for businesses selling online. They don’t have to be exclusive – many businesses use both simultaneously.

Businesses’ own online store

You can sell directly to customers on your own online eCommerce platform. This can be an eCommerce website or a tailor-made app.

The advantage of this is the control it brings. You can design and tweak the buying process and the exact appearance of the online store, etc.

The disadvantages are the set-up and maintenance costs and the relatively limited visibility to new customers (in comparison with established B2B marketplaces). Promoting your store will require general digital marketing efforts to existing and new customers.

Online B2B marketplaces

Online marketplaces for B2B are eCommerce platforms that primarily facilitate transactions between businesses.

They often offer business customers an online sales portal, payments processing and logistics services in one place.

Unique B2B features like invoice payments and automated supply chains are facilitated. Businesses need to be vetted by the platform before gaining access – this reduces overhead costs for individual business buyers.

The platform can also track customer behavior and provides data analytics for both large and small industry players.

Starting your own B2B marketplace is a possibility if you have the resources. However, many businesses sell directly on third-party platforms.

These online marketplaces come in different forms, each which offers unique opportunities for new B2B connections and collaborations:

- Vertical: Specific industry-focused

- Horizontal: Encompassing multiple industries

- Local and global

- ‘Many-to-many’: Direct trading between businesses, charging transaction fees (like stock and bond exchanges)

- ‘One-to-many’: Managed by third parties controlling all bids and exchanges (like auctions)

Advantages of B2B eCommerce

There are several benefits of eCommerce for both business buyers and sellers. Below, we have listed the advantages from the seller’s point of view.

1. Adds a competitive edge

Not having eCommerce capabilities when your competitors do places your business at a disadvantage. It will negatively affect your market share and profitability sooner or later.

And B2B buyer behavior and eCommerce trends are changing. This means that simply having an eCommerce site and presence is not enough.

You need to optimize customer experience, whether this is on your own eCommerce store or an online storefront on an eCommerce platform.

2. Offers limitless distribution span

Existence in the digital world allows business owners and companies to expand their reach with their target audience.

B2B eCommerce can often reach customer groups at all levels of the market – and new markets – at any time.

You can now keep your digital doors open and watch your sales increase beyond expectations.

3. Provides a personal touch

B2B companies are now offering personalized customer experience to eCommerce.

Merchants can connect with their customers through multiple communication tools like email, live chat, instant messaging, and mobile ordering.

Or they can also add features to the website that offers business customers more options than ever before.

Easy, quick, and highly functional UX on eCommerce websites, apps, or other digital channels can make a big difference in sales.

4. Manages suppliers and customers well

Integration with tech (often referred to as digital transformation) can bring incredible benefits to a company.

It enhances their marketing, management, and sales processes. Suppliers and customers have personalized sales portals for them. They can view their browsing history, check out their details, shipping process, and other tracking data.

It lets them have more control over the entire process. As a result, their work becomes efficient and transparent.

Moreover, an eCommerce platform enables you to have better management of the suppliers. You can easily view the raw inventory you have in stock and the progress on orders.

5. Marketing strategies are less expensive

Having social media accounts and pages helps you catch public attention in a better way. But there are some tricks to reach out well.

Search engine optimization is important for both your website and content, so Google can recommend you and for your prospective customers to find you.

Your content should be creative and witty. It’s all about the way you interact with your clients.

Be aware of your marketing messaging. In videos or graphics, it should be entertaining and inspiring. In blogs or any other sort of written content, it should be clear and concise.

Figuring out your ad niche and what platforms to run your marketing campaigns is essential.

6. Defies complexity

An online portal simplifies processes and links with a bunch of other plus points. One of those is the reduction of workload.

Instead of employees, customers have to do the heavy lifting with digital configurators. When they are asking for a personalized product, they automatically execute half of your task.

7. Improves data analytics

B2B eCommerce brings a perfect forum for the organization to launch a comprehensive analytics campaign.

Companies can measure and evaluate their promotional campaigns. They can study their sales effectiveness, inventory turns, product mix, and customer engagement.

When you have all this customer data at hand, you can take valuable measures to improve company performance that contribute to better business decisions.

8. Boosts sales engagement

Your physical sales reps can also benefit from eCommerce. Online data can often provide them with the ability to view client orders, pricing, and history.

Gone are the days when employees used to feel totally detached from demand and supply.

Plunging into eCommerce equips you with an ability to set up multiple channels, where the entire workforce can gather.

They can also provide their input on essential matters and offer help where needed.

9. Increases automation

In a B2B eCommerce context, automation can cover inventory management, order processing, pricing, customer service, sales, marketing and more.

Automated inventory management, for example, ensures real-time stock tracking. This can reduce errors, such as overstocking. And it helps keep orders and pricing information accurate and eliminates the need to request order updates.

This in turn can keep businesses better prepared for eCommerce trends in a target market and can help keep your supply chain more efficient.

And automated invoice processing can help keep customer data and business systems up-to-date and accurate.

Overall, these automations increase efficiency, reduce costs, and – in the long run – help drive revenue growth.

B2B eCommerce challenges

Opening or entering B2B eCommerce channels is not without its challenges.

If you are opening your own eCommerce platform, there are several areas to consider:

- Set-up and maintenance costs

- Time to market (TTM) estimates and timing

- Logistics

- Payment security (see below, ‘Payment security and fraud’)

- Growth strategies

- Third-party software

And more.

Joining a third-party eCommerce platform can bring a high volume of new customers and increase in average order volume (AOV).

Keeping pace with this can be difficult. It requires a range of potential scaling tasks such as integrating your existing technology, enlarging your sales team, and switching payment providers.

B2B payments

Frictionless and flexible payment options for online transactions are essential for B2B eCommerce. An erratic or slow buying process can cause high abandoned cart rates and defections to competitors.

Unlike with B2C, B2B payment processing often starts with invoice issuance and processing.

Common payment methods include checks and bank transfers that often result in slow collections and late payments, which can affect cash flow.

For instance, the average UK SME chases five outstanding invoices at any given time, totaling approximately 8,500 GBP.

Utilizing a third-party B2B payment solution can lower administrative costs, reduce risk, and improve cash flow.

This also allows for enhanced payment options, including payment processing and financing capabilities. While providers may charge setup and transaction fees, increased sales and order volumes usually offset these costs.

Payment security and fraud

Despite the lowest fraud levels since 2014, B2B payments still experience significant fraud attempts. In 2022, businesses reporting losses of $42B.

B2B transactions are susceptible to exploitation. So, trust is vital if digital verification processes are to be completed safely but without friction.

Offering multiple payment and financing options can increase the likelihood of making a sale. Balancing security, choice, and customer experience is critical in the B2B payment experience.

Point-of-sale (POS) integration with eommerce platforms

POS integration with eCommerce helps with sales, inventory management and data collection.

This allows for real-time updates and optimization and automates prices and promotions, inventory management, and delivery capabilities.

The increased operational efficiency it brings can ultimately lead to an enhanced customer experience. It does this in part by freeing up employees to focus more on customer service.

It also ensures a consistent brand experience across all channels, avoiding confusion due to mixed messaging or pricing discrepancies.

This makes an eCommerce platform an integral part of the store experience rather than an optional extra.

Providing financing options to your B2B customers

What type of customer financing you offer depends on what type of customer you have.

In retail eCommerce, customer financing options are often offered at the point-of-sale (POS). It allows customers to pay for purchases through low-interest or interest-free installments over a short period.

B2B financing also allows customers to own products sooner without relying on third-party lenders or their credit card balance. But it goes beyond this, too, with more complex options such as:

- Lines of credit

- Venture debt

- Invoice financing (including invoice discounting and factoring)

Offering B2B financing options to customers can bring a number of benefits. This includes increasing conversions and repeat purchases, attracting a broader audience, and boosting customer loyalty.

Recent studies suggest BNPL can improve retail conversion rates by 20-30% and increase average transaction value by 30-50%.

B2B “Buy Now Pay Later” (BNPL)

Buy Now, Pay Later (BNPL) is a popular financing option that enables buyers to make payments for purchases in (often interest-free) installments and with no deposit. It is distinct because of its point-of-sale (POS) accessibility and predetermined installment options.

It is very popular in the B2C world, where it sometimes faces criticism for potentially promoting irresponsible spending. This has prompted stricter regulation in some countries.

The business-to-business (B2B) variant of BNPL is the same financing concept in practice, but is different in principle.

Like the B2C version, it improves cash flow management by spreading out payments for large purchases. And it involves fewer credit checks and faster onboarding than most other financing options.

This enables businesses to quickly allocate their spending elsewhere and to take advantage of discounts for larger orders, for example.

B2C BNPL handles high volumes of small transactions. By contrast, B2B BNPL deals with smaller volumes of larger, more complex transactions requiring integration with broader business systems.

B2B BNPL also includes transaction fees for buyers, unlike with B2C, where sellers typically bear these costs.

B2B eCommerce examples

1. Computer company boosts AOV by 114% with credit line

A multi-national consumer electronics company implemented a pay-by-purchase order line of credit program in its B2B stores. This resulted in a 114% increase in average order value (AOV).

The program was launched in 14 countries to provide more flexible and convenient payment options.

These included purchase orders with net terms at checkout. This facilitated a smoother, consumer-like online shopping experience for B2B buyers.

In turn, it also improved buyer loyalty, increased repeat purchases, and streamlined accounting operations.

The increased cashflow that resulted from this enabled the company to scale their B2B programs globally.

This solution saw AOVs that were 4.5 times greater than other online orders. In total, they and represented 16% of the company’s total online revenue.

Read the full credit program use case here.

2. Shipping company increases average month-over-month spending by 150% in 10 months

A US-based online marketplace platform linking shippers and carriers successfully transitioned from a B2C to a B2B marketplace by implementing B2B payment solutions.

The expansion provided:

- A seamless checkout experiences

- Real-time net terms

- BNPL options

- Dynamic pricing

The company experienced faster than expected growth, with a 450% increase in average month-over-month spending per account in just 10 months.

According to their product manager, the solution enabled them to focus on expanding their shipping business.

Learn more about this B2B payments use case here.

3. Hotels gives corporate customers more flexible payment options

An international hotel chain partnered with a B2B payments company to simplify corporate travel booking and payment experiences.

It leveraged a direct billing solution to increase average occupancy rate (AOR) and build loyalty.

The solution allows corporate clients to reserve stays and checkout without a physical payment card – all stays are directly invoiced back to the company.

Benefits include:

- Increased revenue per available room (RevPAR)

- Enhanced brand loyalty

- Risk-free accounts receivable (A/R) automation

- Time savings for (A/R) teams

- Easy integration

Read the full hotels payments case study here.

TreviPay: B2B payments and eCommerce solutions provider

TreviPay’s global B2B payment and invoicing network can help you adapt and thrive in the world of B2B eCommerce.

It caters to unique B2B seller needs, helping with enhancing payment convenience, automating receivables, and exploring new markets.

Leveraging 40+ years of experience, TreviPay focuses on efficiency, digital channels, and loyalty in sectors like manufacturing, retail, transportation, and more.

Summary

B2B eCommerce has gone from ‘having potential‘ to ‘being essential‘ as a sales channel. And your existing customers’ expectations will grow alongside the B2B eCommerce market’s growth.

Failing to invest in it can end up being a costly mistake.

If you own or manage a B2B business, you should start thinking about opening or optimizing your eCommerce channels.

Using eCommerce in your B2B organization helps you add a competitive advantage, offers a wider distribution span, provides better customer experience, and aids managing suppliers and customers.

It makes marketing strategies less expensive, defies complexity, eases up analysis, and boosts sales engagement.

If you’re looking for B2B eCommerce solutions partner, TreviPay can help.

eCommerce is the future for B2B transactions. To ride the wave of its growth, rather than get swept away in its wake, take action now!