Credit is a powerful and useful tool, but it should be handled with care.

Whether it’s for purchases, mortgages, loan approvals or B2B financing, many organizations need to create a clear and effective credit decisioning process.

Understanding the principles and decision strategies involved is useful knowledge for both credit applicants and credit providers.

What is credit decisioning?

Credit decisioning is the process of evaluating a potential borrower’s creditworthiness. Its goal is to determine whether to approve, deny or adjust credit applications.

It involves examining a range of factors related to the borrower’s ability and likelihood of repaying credit.

To banks, credit card companies and many businesses, credit decisioning is a routine and vital part of work.

It needs to be reliable and efficient because extending credit can benefit or disadvantage lenders enormously.

What factors play a role in credit decisioning?

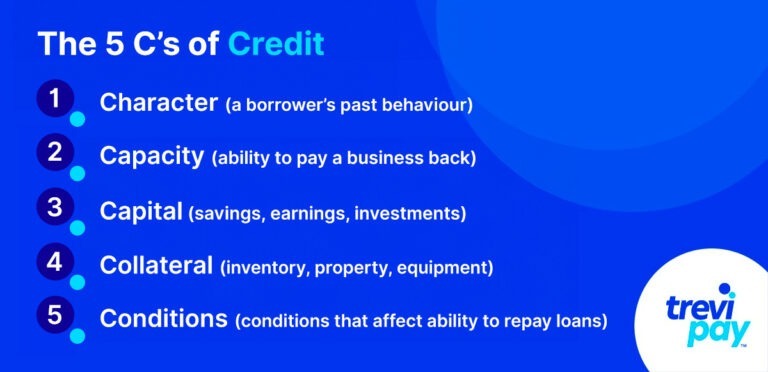

The most widely known credit decisioning model is the 5 Cs of credit.

The 5 Cs of credit

The 5 Cs of credit is a framework for evaluating a borrower’s creditworthiness.

By evaluating each ‘C’, lenders can make informed decisions about who they lend credit to and what rates to offer.

1. Character

English political writer, Thomas Paine, wrote: “Character is much easier kept than recovered.”

In credit decisioning, character essentially refers to a borrowers’ past behavior. It includes their previous credit repayment history, their reputation, and other information about their business dealings. Defaults, late payments and poor credit history all work against borrowers.

Credit decision-makers are also looking for signs of reliability, such as punctual or early repayments. For this, checks on credit history, employment records, sales and revenue records, personal references and other data are used.

In short, a borrower with a good character is considered a lower credit risk, and is more likely to receive better payment terms.

2. Capacity

This refers to the ability of the borrower to pay a business back. A lot of factors come into account for evaluating this: existing and projected revenue, current outgoings (perhaps including other debts), assets, collections processes and more.

The higher capacity a potential borrower has, the lower risk they are. And the more likely they are to be approved for extending credit.

3. Capital

Capital includes earnings, savings and/or investment into a business.

Lenders see different sources of capital as both a signal of borrowers’ debt repayment abilities and business health more broadly.

It is also be seen as a sign of a lenders’ level of commitment to a business. If someone is highly invested in a business, they are likely to be highly motivated to make it succeed, too.

4. Collateral

Collateral is something that can be put up as security in the event a loan can’t be repaid. It can include things such as: inventory, property, business equipment, cash or invoices.

It is not always required, but in the circumstances where it is, the lender’s risk is reduced. Or, to look at it from the borrower’s perspective: it increases the chance of securing credit.

5. Conditions

This refers to economic conditions that may affect the borrower’s ability to repay loans.

These include macroeconomic conditions and circumstances more specific to the borrower. For a business, this could mean the current or predicted conditions in their industry or niche.

Risk vs reward in credit decisioning

Financial institutions and businesses going through the credit decisioning process need to consider two critical main issues for every case: risk and reward.

Providing and receiving credit, whether it’s a traditional loan, access to trade credit, or simply longer payment terms, is a always risk.

Conditions outside of both the lender’s or borrowers’ control might cause late repayments or defaulting on repayments.

But the rewards are high, too. Firstly, the ability to offer credit can win customers from competitors who don’t offer it.

Secondly, credit solutions can enable businesses to increase the average order volume (AOV) their customers make – this is especially true for B2B businesses offering trade credit. This in turn can have positive implications for customer satisfaction and customer loyalty.

The importance of fraud protection

Preventing loan fraud is one of the most important aspects of credit decision strategies.

Several things can be checked to help spot this. The checking is done in order to score buyer data against known data and look for variances.

For example, if the applicant is blacklisted. Or, if it’s a company, to see if its directors have been dumping shares recently.

Digital applications include an extra layer of data for banks and businesses to analyze, sometimes referred to as ‘digital fingerprints.’ IP addresses, for example, can be aggregated with location data and other critical data points.

Automated credit decisioning

Previously, the credit decisioning process involved travel for in-person interactions in banks, factories or warehouses.

These days, it’s increasingly being automated and taking place online. This brings efficiency gains for both lenders and borrowers, helping both parties save time and resources.

Borrowers can get near-instant decisions or offers from multiple lenders. And lenders can make decisions and offers to multiple borrowers, too.

Automated models can also reduce credit risks and costs for lenders. Given the right data, machine learning models can make more consistent and smarter decisions than humans.

When a system identifies a potential fraud concern with an application, a credit or fraud analyst can be brought into the process. They can examine the data more closely and exercise their judgment on the case.

What happens after granting credit?

For businesses, credit decisioning can be viewed as a part of the wider order-to-cash (O2C) process.

This involves the organization of everything from when an order is made until when it is paid, including fulfilling and shipping its orders, processing its invoices and collections.

Outsourcing credit approval

Outside the financial sector, businesses don’t often have the ability to directly offer credit to potential customers.

In these cases, they can rely on third parties. Such services will take care of credit decisioning on behalf of businesses via a white-label financing solution.

TreviPay’s credit decisioning model

TreviPay specializes in B2B financing and trade credit solutions. Our solution enables you to offer automatic credit of up to $100,000 to your customers without underwriting it.

Unlike credit cards, these funds can only be spent with you. With additional information, we may extend less or much more credit.

Our credit risk models use customer information and advanced analytics to make quick and robust credit decisions.

It also effectively screens online applications for fraud, removing suspicious cases from the automated process once they are detected. This entire automated risk assessment takes place within a matter of seconds.

Conclusion

Credit decisioning is the process of evaluating a potential borrower’s creditworthiness.

It takes place at the beginning of the customer lifecycle, which is perhaps the most critical stage. Credit providers and borrowers both want to weigh risk and reward and find the right rates and terms.

The most widely known credit decisioning model is the 5 Cs of credit, which are character, capacity, capital, collateral and conditions.

Preventing loan fraud is one of the most important aspects of credit decision strategies.

There are great benefits to automating credit decisions. Businesses are increasingly choosing to implement such technology. Each new credit decisioning model will analyze external data sources with increasing speed and accuracy.