Some metrics are useful in general but not in particular.

Days sales outstanding (DSO) is a good example.

As a broad rule of thumb, it is usually useful, but sometimes misleading.

So, it’s important to understand its nuances and conditions. Then you will have a great baseline metric for your company’s financial health.

What is days sales outstanding (DSO)?

Days sales outstanding (DSO) (also known as days receivables or cash collection period) is a measure used to help determine the state of businesses’ collection process.

It looks at the average number of days it takes for accounts receivable departments to collect cash from outstanding invoices.

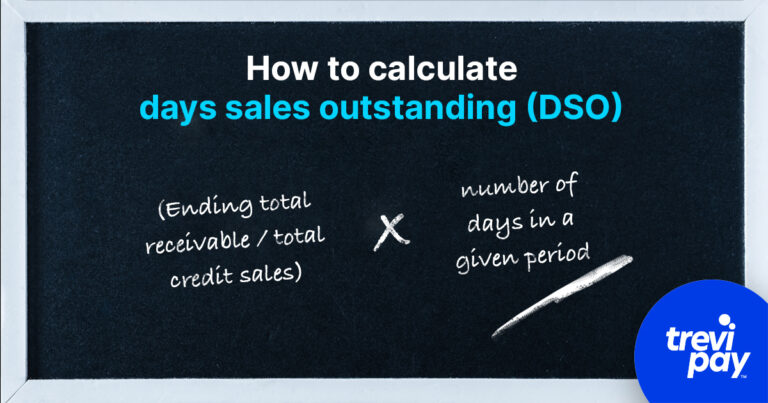

How to calculate days sales outstanding

Calculating DSO is relatively simple to do.

Firstly, there are two main variables to consider:

- Ending total receivables: Your accounts receivable balance

- Total credit sales: The value of your outstanding invoices (usually given in dollars, pounds, euros, etc.)

Once you know these figures, you insert them into the following formula:

- (Ending total receivables / total credit sales) x number of days in a given period

Choosing the time period for your DSO calculations

Which time period you choose for the final part of the equation (the ‘number of days in a given period’) is important.

It can be measured monthly, though for some businesses this may be too short of a period to gain real insights.

Quarterly is useful for comparing your company’s performance throughout the year and for the same period in different years. And annually enables comparisons with other years.

Example DSO calculation:

A company’s total receivables for the first quarter (91 days) were 10,000 USD, and its total credit sales were 18,000 USD.

So, calculating their DSO value should look like this:

- (10,000 USD / 18,000 USD) x 91 = 50.5 days

10,000 USD is divided by 18,000 USD (0.5555555556), times this by 91 equals 50.5 (we round up the longer number – 50.555555556 – to one decimal point).

So, this company’s DSO is 50.5 days, i.e., it takes 50.5 days for it to convert its average accounts receivable into cash.

Don’t include cash sales in the accounts receivable balance

Only credit sales revenue should be included in your DSO calculation. Cash sales should not be.

Cash sales essentially have a DSO of 0 because customers pay immediately. This means they skew the days sales outstanding calculation when mixed with credit sales.

Different companies also have different mixes of cash and credit sales revenue. If you have more cash sales, for example, an inaccurate DSO calculation might not have as big of a negative impact. But if this mix changes over time, it will.

How to determine how good or bad a DSO is

DSO calculations without context don’t tell the whole picture.

For example, on its own, the statement ‘a high DSO is bad and a low DSO is good‘ is true. It holds when you are discussing this subject in very broad terms.

However, its usefulness decreases when you are discussing more specific situations. For these situations, there are four main points that it is essential to consider.

1. DSOs are relative to industries and geographies

A DSO number means something different to each company, industry, and geography.

Your DSO value should only be considered good (low) or bad (high) relative to your industry.

For example, a construction company’s DSO (80 days) might look high in comparison to a railroad transportation company’s DSO (55 days).

But perhaps the construction industry’s (median) average DSO is 82. And the railroad transportation industry’s is 31.

Your geography also needs to be considered. The median DSO for steel manufacturers in the US might be different from the one in China.

A DSO that gets higher – relative to its industry’s median – over time is generally not a good sign. It could mean your company is taking too long to collect its receivables.

2. Company size matters

When comparing companies within the same industry, it’s also important to keep in mind their size.

Larger companies generally have more resources and a more established and efficient collections process. They might also have more bargaining power with customers. These factors can naturally lead to a shorter DSO.

Furthermore, a small company’s cash flow is likely to be dependent on a smaller range of customers. What a low or high DSO number suggests might simply be misleading because of this.

3. DSOs change over time

DSOs change for companies and industries each year. They also change within different points of the same year, too.

One survey found that in the hotel industry between 2020 and 2021, the average DSO dropped by 8%. By contrast, for the IT industry in the same period, it increased by 6%.

Watch out for trends over time

Your DSO increasing – relative to its industry’s median – over time is generally not a good sign. It could mean your company is taking too long to collect payments on its receivables.

And while a DSO that’s low relative to your industry is generally positive, one that’s too low or decreasing might not necessarily be.

It might mean your collection policy is too stringent. This fact might discourage existing and potential customers.

So, watching out for all trends is important. They are signals of change within your company or industry.

4. Higher DSOs can be necessary by-products of credit sales

Increasing your DSO, even to the point that it is relatively high for your industry, is sometimes necessary.

This might be the case when you need to extend trade credit or other forms of B2B financing to customers in order to gain more business.

It’s down to your business to decide whether or not increased sales from offering credit outweigh the need to decrease your DSO.

Your company’s collections department should consider customer satisfaction and customer retention, too. Slightly delayed payments don’t need to be treated like unpaid invoices.

How you can improve your DSO

There are several ways you can improve your DSO. These include:

- Extending terms to buyers

- Speeding up accounts receivable processes

- Incentivizing buyers

- Offering multiple payment options

- Improving order-to-cash (O2C) process

- Improving the dunning process

- Automation

- Outsourcing collections process

- Implementing effective cash management strategies

Metrics other than DSO to consider

DSO is not the only metric for measuring your company’s cash flow and financial health.

Gross margins, operating margins, and net profit margins are measures for financial health more generally, too.

And the cash conversion cycle (CCC) is a metric closer to DSO. It measures how long it takes to collect payment for goods after investment in resources, inventory, and sales. This is measured in days – the more days, the longer the cash flow is delayed.

Improve your DSO with TreviPay

If you are looking to automate your B2B company’s DSO and increase cash flow, TreviPay can help.

Our specialist accounts receivables management technology can ensure you get paid in days. It automates your days sales and outstanding balances by extending risk-free credit to your customers.

Implementing TreviPay’s solution enables your business to provide multiple payment options and lower its DSO. This can ultimately remove the challenges caused by a restricted cash flow.

Conclusion

Understanding days sales outstanding (DSO) can help you determine the efficiency of your company’s collections processes.

It is calculated by using the formula: (Ending total receivables / total credit sales) x number of days in the given period.

In order for it to be a useful financial metric, DSO should be considered in relation to your company’s industry, size, and geography.

It can change over time, and trends should be monitored closely. An increasing DSO could mean your company is taking too long to collect payments. A decreasing one might indicate a too stringent collection policy.

And sometimes, a higher DSO is necessary when extending trade credit to customers to gain more business.

To improve DSO, companies can extend terms to buyers, speed up accounts receivable processes, offer incentives, provide multiple payment options, and implement automation or outsourcing. Implementing payment automation can significantly reduce DSO by streamlining accounts receivable processes and ensuring timely payments, which is crucial for maintaining healthy cash flow.

Besides DSO, other financial metrics like gross margins, operating margins, net profit margins, and cash conversion cycle (CCC) can also help assess a company’s financial health.