There are many B2B financing methods available.

Some of them are known by more than one name. Or their name is often mixed up with a different financing term.

Two of the most commonly used and confused methods are invoice financing and invoice factoring.

Let’s look at the similarities and differences between them, their relative pros and cons, and clarify some other relevant terms along the way.

What is invoice financing?

Invoice financing is a business financing method of using your existing open invoices to get a loan for 75 – 90% of their value upfront.

The precise amount you receive upfront depends on your particular provider and the terms you agree. They calculate this by looking at a number of risk factors associated with:

- Your industry

- Your company

- Your clients

What’s the difference between ‘invoice finance’ and ‘invoice financing’?

Invoice finance is an umbrella term that covers several types of financing, including invoice financing and invoice factoring.

The similarity between these two terms often leads to them being mixed up.

What’s the difference between invoice financing and invoice discounting?

Invoice financing and invoice discounting are simply different terms for the the same thing.

Invoice financing is a term which tends to be used in both North America and the UK. Whereas invoice discounting tends to be used in the UK but less so in North America.

What’s the difference between invoice discounting and discounting?

Invoice discounting is a type of invoice finance, whereas discounting is a different financial arrangement where a debtor delays their debt payments in exchange for a fee.

What is invoice factoring?

Invoice factoring is a popular type of invoice finance in which you sell your outstanding invoices to a third party factoring company (often known as a factor).

The factor provides you with between 75 – 90% of the invoice value upfront. It then collects the invoices on your behalf from your customers when the payment is due.

Finally, the factor pays you the remaining balance (minus its invoice factoring fees).

Different types of invoice factoring

There are several variations of invoice factoring. These include:

- Selective factoring (also known as spot factoring): You select exactly which invoices the invoice factoring company buys

- Recourse factoring: The factoring company takes on full liability of invoices, including unpaid or disputed ones

- Non-recourse factoring: You take on liability of all invoices

- Notification factoring: Your customers are notified that a there is a third-party involved in collections

- Non-notification: Your customers are not informed of a third-party involved (the invoice factoring takes place under your company name)

What is the most common type of invoice factoring?

Different industries and providers have different norms. But in general, the most common invoice factoring is: non-selective (i.e., your whole sales ledger), non-recourse notification factoring.

The similarities between invoice financing vs invoice factoring

1. Increased cashflow

Invoice financing and invoice factoring are different kinds of invoice finance.

Their main benefit is the same: they help you utilise your existing invoices to increase cashflow.

2. Quick and convenient to deploy

They are both also relatively quick to deploy. Onboarding requires less credit checks and other financial requirements than a traditional bank loan.

Providers are usually more interested in your customers’ reliability and financial situation than yours.

3. Build long-term readiness and confidence

The upside to improved cashflow and quick deployment goes beyond the short term…

Combined, these benefits mean you are ready for opportunities such as large orders or a big contract. Or they help you weather difficult financial periods where working capital is essential.

4. Relatively expensive forms of financing

The downside of these conveniences is that both invoice financing and invoice factoring are relatively expensive forms of financing. Long-term use of them is not often an efficient way to finance your business.

5. Risk

They both also involve some risk. If your customers pay late or default, your business could be charged for late payments and/or liable to pay back invoice payments to the financing provider.

And in some cases, you may need to pay to leave your contract.

6. Handing over the full sales ledger

Both solutions usually require your business finances all of its invoices, not just a selected few.

There are exceptions to this, such as selective factoring. But these might require more expensive rates or higher qualifying criteria.

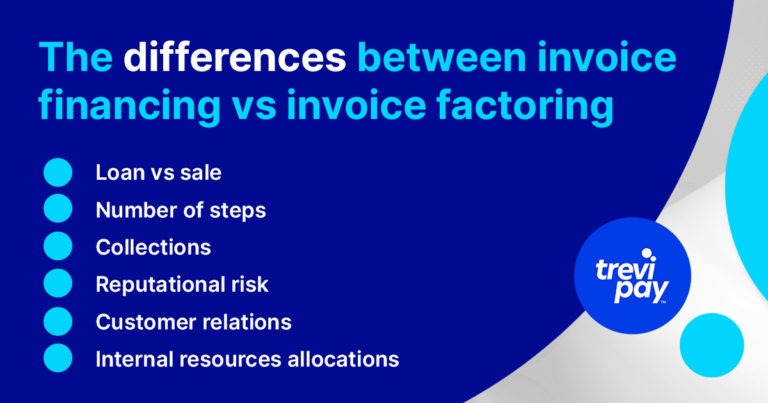

The differences between invoice financing vs invoice factoring

1. Loan vs sale

Invoice financing is essentially a kind of loan that uses your invoices as collateral, whereas Invoice factoring is more like a sale that uses your invoices as a product.

Understanding this conceptual difference is useful. It helps you better appreciate the following differences…

2. Number of steps

Invoice financing involves fewer steps than invoice factoring. From the provider’s point of view, financing is a simpler process because they do not collect payments on your behalf.

But whether financing or factoring is the simpler option for you depends on your business’s circumstances.

3. Collections

Most forms of invoice factoring include a collections service. Once factors have bought your invoices, they handle your communications and payments.

Payments chasing and processing invoice payments is important but time-consuming.

You can build best practices around your collections, but you might still lack the resources at certain times.

Factoring companies can relieve your team of having to collect customer payments. The factor might even prove to be more efficient at collections, even to the point of preventing late or unpaid invoices.

From this point of view, invoice factoring can simplify your team’s work.

4. Reputational risk

An advantage invoice financing has over invoice factoring is that your customers don’t need to know that you are using a financing service.

After all, there is always a risk that some will interpret a factoring company getting in touch on your behalf as a negative sign about the stability of your business.

5. Customer relations

Collections involve a lot of communication. An invoice financing company does not get involved in this, but an invoice factoring company usually does.

You can’t maintain control over the factor’s payment chasing methods or manner. If it is markedly different to yours, it might damage your working relationship with customers.

6. Internal resources allocations

Outsourcing your collections to a factor might be a bonus. Whether you are in a period of high growth or financial difficulties, it is likely that you will need all of your employee resources on hand.

A good factoring company can essentially serve as an experienced and effective accounts receivable service.

Invoice financing vs factoring: How do you know which one you should choose?

There are many different factors – and providers – to consider before you decide whether to use invoice financing or invoice factoring.

Here are some general principles that might help with your decision.

If you don’t have many invoices

If you don’t have a lot of customers, you won’t have a lot of invoices either. This might apply to you if you are a startup or simply have a small pool of customers.

Invoice financing or factoring could still improve your cash flow, but it might not significantly do so. And it might not be worth risking disrupting your reputation and relationship with your existing customers.

If you have a lot of invoices

Processing invoice payments can take up a lot of resources.

If you give your clients long payment terms, an invoice financing or factoring solution could help you get on top of your accounts receivable.

This might be the case if you are an established business working in an industry where longer payment terms are the norm, or if you simply have a lot of invoices.

If your internal resources are stretched and/or you have a lot of unpaid invoices, then factoring would likely be a better choice.

Alternatives to invoice financing and factoring

There are several alternatives to consider for securing working capital for your business.

A traditional business loan is probably the most cost-effective but time-consuming.

For start-ups or early-stage companies, crowdfunding and equity financing are alternatives. However, these too may take months to complete.

Providing invoice financing or factoring to your clients

Passing on the benefits of an invoice finance solution to your clients can increase spending and customer loyalty and decrease time to sale.

Using a trusted third-party provider like TreviPay enables you to reliably and rapidly deploy trade credit solutions.

Our platform can make onboarding decisions in less than 30 seconds and comes with automatic regulatory compliance and real-time fraud monitoring.

Conclusion

Invoice financing and factoring are fast and convenient forms of short-term borrowing.

Both are a form of invoice finance. Unlike many other forms of financing, this helps you leverage your own sales ledger to increase cash flow.

They have many similarities. These include their convenience and cost.

They also have some key differences. Invoice financing does not include collections, whereas most forms of invoice factoring will.

This can be either an advantage or disadvantage, depending on your viewpoint. Outsourcing your collections might make it more effective. However, keep in mind that it might also damage your reputation and disrupt your client relationships.

Being able to offer either service to your clients can increase their spending and offer a valuable solution to cash flow issues.