On behalf of TreviPay, Windward Strategy, a B2B payments consultancy surveyed North American mid-market B2B suppliers. This survey aimed to uncover trends in B2B buyer purchase channels, credit granting and payment experiences. From our survey findings and insights corroborated by prominent entities in the B2B sector, we’ve distilled three actionable strategies to enhance your B2B buyers’ experience.

Implement Flexible Payment Solutions

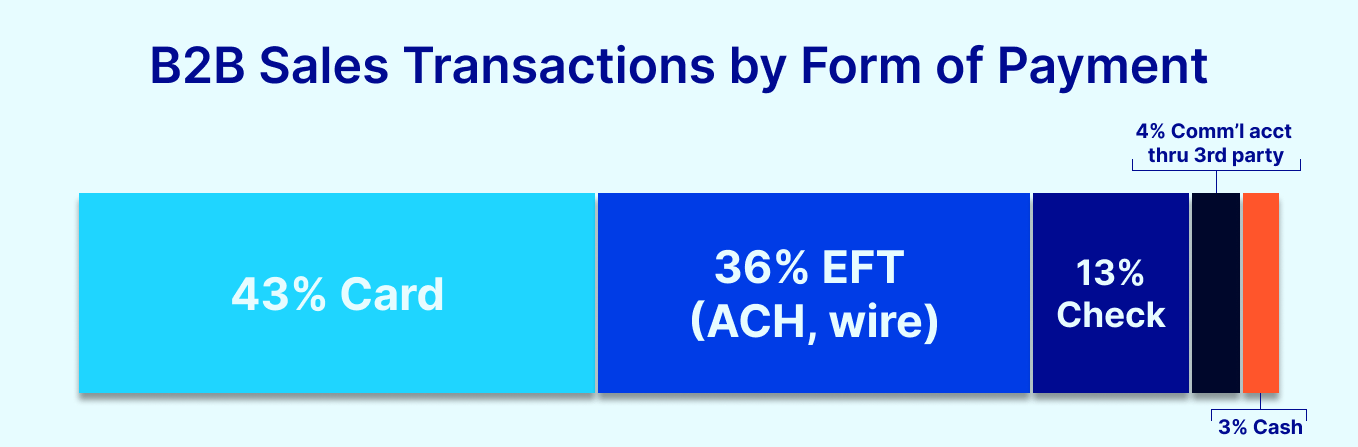

Offering the right payment options without overwhelming the buyer can be a tough balance yet critical when growing B2B market share. According to Manhattan Venture Research, 91% of buyers said if their specific payment requirements weren’t met, they would switch suppliers. Our survey found that the most common payment type required was card, accounting for 43% of transactions, making it a critical option for suppliers to offer.

EFT and other non-digital payment methods were still present, however, usage continues to decline. This trend was echoed in a Forbes’ 2023 report, finding while 33% of B2B transactions were still made by paper check, yet 20% of Gen Zers have never used a paper check. This generational shift will not happen fast, according to “The Slow Road to Faster Payments” in 2023, 60% of businesses still use mostly paper invoices.

Create an Easier Online Purchasing Experience

Nearly half of B2B customer purchases are initiated on the suppliers’ website, according to our survey. A McKinsey survey also indicated eCommerce becoming the most offered sales channel for B2B companies.

Suppliers find eCommerce promotes loyalty and is the lowest cost to serve. However, Modern Treasury found financial decision-makers lose nine hours of work time per week resolving payment operations issues, indicating there is a lot of room for suppliers to streamline the payments experience.

Manhattan Venture Research identified the top four elements influencing decision-makers as:

- In-cart financing

- Fast approval

- Digital invoicing

- Payment options

By offering these features, you’ll be a step ahead of your competitors by increasing efficiency for customers.

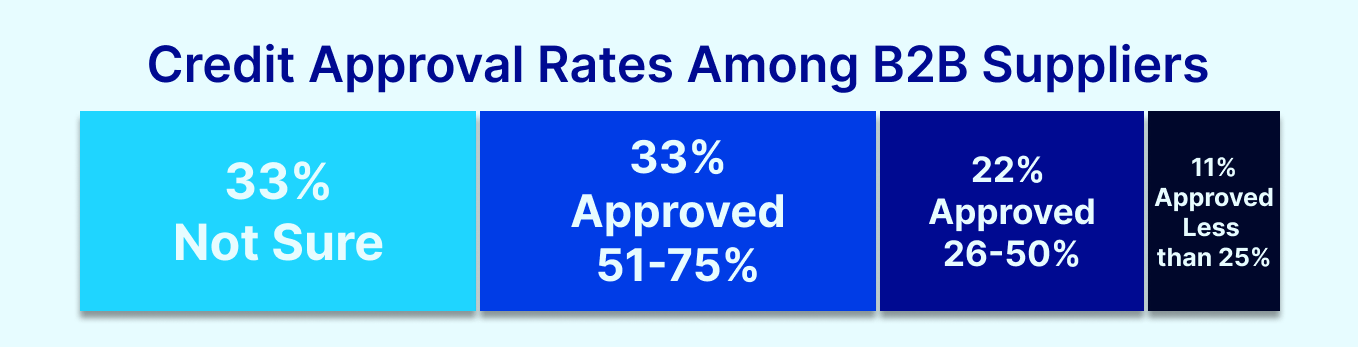

Establish Transparent Credit Approvals

As many as one-third of B2B suppliers’ decision-makers surveyed aren’t sure what percentage of their prospective B2B customers are currently being approved for credit and thereby able to make purchases on terms. This uncertainty can lead to confusion and potential lost sales particularly when most B2B suppliers would like at least half, if not three-quarters of their prospects/customers to be approved for credit.

Understanding and adapting to evolving buyer preferences is important in B2B transactions. Our survey highlights the critical need for flexible payment solutions, streamlined online purchasing experiences and transparent credit approvals. These actionable insights underscore the importance of embracing diverse payment methods, enhancing digital pathways and fostering clarity in credit processes.

TreviPay’s innovative B2B payments network stands ready to empower enterprises, offering varied choices, market expansion and efficient receivables automation. By implementing these strategies, businesses can optimize the B2B buyer journey and thrive in an ever-evolving market.