The market value of cross-border payments is soaring.

The Bank of England estimates that by 2027, it will have risen over $100 trillion USD compared to the decade before.

Payment localization is an important part of this market and businesses’ ability to grow internationally. Whether you are considering growing an existing presence in a country by offering payment localization, or looking to enter a new market, payment localization is crucial.

But what is payment localization? How does it work? And what are its pros and cons?

What is payment localization?

Payment localization is the process of adapting payment methods, systems, and interfaces to align with the preferences, regulations, and cultural norms of specific geographic regions or markets.

This includes offering local payment methods that are:

- Popular and widely used in a particular region

- Comply with regional financial regulations

- Provide information (including local currency listings) and customer support services in local languages

Why is payment localization important for business growth and expansion?

There is a difference between providing customers in another market payment services and providing localized payments. Simply providing non-localized international payments options might capture some customers. However, localizing payment services brings improvements to:

- User experience

- Conversion rates

- Trust and customer loyalty

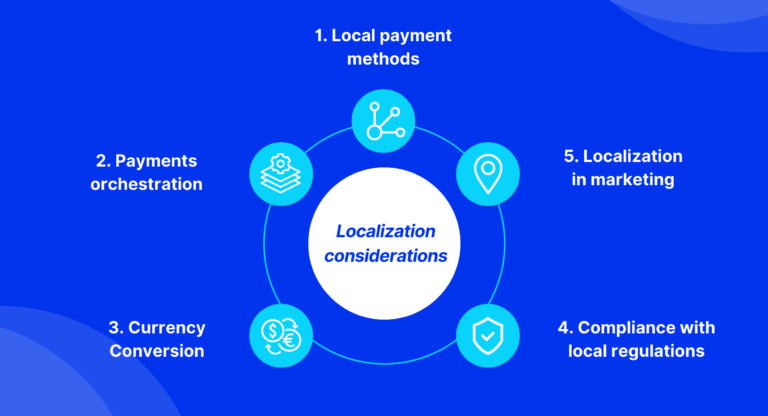

Localization considerations

Expanding your business internationally comes with the challenge of adapting your payment processes for local markets. Some challenges and considerations to think about are:

- Local payment preferences

- Partnerships with local payment providers

- Currency Conversion

- Local Regulations and Compliance Rules

- Localization nuances and expectations

1. Local Payment Methods

Merchants seeking a broader international customer base may choose to support all possible payment methods and other services. Either to address consumer demands in various markets or to offer multiple payment options within a single market.

To achieve this, they usually need to partner with payment services providers (PSPs) that support local and payment solutions and gateways. For example, Chinese consumers usually pay via either Alipay or WeChat Pay, whilst the Paytm wallet is a popular payment method for consumers in India. Supporting preferred local payment options is crucial.

Focusing on essentials

Offering multiple local payment methods is great for consumers. But it can become a headache for a business looking at multiple payment gateway partners to support localized experiences.

It is important not to rely on one single payment gateway and to consider the most suitable platforms for processing transactions. This involves more than just the customers’ geographic locations. Transaction success rates and currency exchange rates can vary significantly. Each depends on the selected payment gateways.

To manage this complexity, merchants should seek the help from the right PSPs who can understand and oversee these dynamic factors.

This process can become extremely burdensome without a payment orchestration layer.

2. Payments Orchestration

Payments orchestration is a strategic approach to managing and optimising multiple payment methods, providers and channels within a single unified platform. Payment orchestration allows a business to offer multiple localized payment methods.

It takes place on a payment orchestration platform, which allows businesses to dynamically route transactions through different payment networks, gateways and processors. Its decisions are based on factors such as:

- Cost

- Performance

- Availability

- Customer preferences

By integrating different PSPs, payment orchestration streamlines the payment process, enhances user experience and ensures compliance with regulatory requirements. Businesses are then equipped to deal with changing market dynamics, support preferred payment methods, and optimize costs and performance across their payment infrastructure.

Are payment orchestration platforms and payment gateways the same?

A payment orchestration platform is different to a payment gateway. The latter is necessary for accepting all electronic payments. By contrast, the former is necessary for handling international transactions, multiple currencies and multiple payment methods.

3. Currency Conversion

Currency conversion enables seamless transactions across international borders while catering to global trade and the wants of diverse customer bases – even in unfamiliar territories.

It enables businesses to offer local pricing and accept instant payments made in multiple currencies. This enhances customer experience and increases conversion rates.

Complexities of offering currencies

However, currency conversion also introduces complex challenges. Fluctuating exchange rates can impact pricing consistency and profit margins and add transaction fees related to currency conversion for both businesses and customers.

4. Compliance with local regulations

Compliance in payment localization ensures:

- Adherence to legal requirements

- Protection of customer data

- Trust in the global marketplace

In many cases, businesses are obliged to comply with local regulations. These are primarily designed to underpin data security and privacy and protect sensitive customer information from unauthorized access or misuse.

Local compliance naturally enhances trust and credibility in business among customers and partners.

Compliance requires resources

However, navigating the regulatory frameworks of each region presents challenges. It requires significant resources, expertise, and ongoing monitoring to ensure alignment with evolving laws and standards.

Strict compliance restrictions can also impose operational constraints and increase the complexity of payment processes. So, choosing an experienced and reliable partner is crucial.

5. Localization in marketing

Localization is a frequently used term in the marketing and translation industries. It is largely made up of the following two components.

Language support

Local language support is something that can be easily overlooked when considering payment localization options.

Customer support in local languages improves accessibility and comprehension, reducing barriers to completing transactions. These factors can all be more challenging in today’s business-to-business (B2B) payments environment.

It goes beyond straightforward translation…

Straightforwardly translating your product information and other materials is – like simply accepting international payments – useful up to a point.

However, localizing your material – i.e., rewording translations to suit the new market – can make a big difference.

This personalized approach increases customer satisfaction and fosters trust in the brand, leading to higher conversion rates and customer loyalty in different regions.

However, it does come at a cost…

Localizing content accurately and effectively requires resources, experience, and expertise. Consistency across multiple languages must be maintained and monitored, which can be complex and time-consuming.

Other cultural nuances

Different markets have different cultures. This influences consumer preferences, expectations, and behaviors in different regions.

Adapting to new cultural nuances should be a key priority in your payment localization strategies. It will improve the user experience, foster trust and improve customer satisfaction.

However, it requires research, resources, and expertise.

Example: Working in the Chinese market

For example, China has the largest eCommerce market in the world.

Businesses looking to enter this market will often need to open a separate website domain. And simply duplicating an existing website – no matter how well the text is translated and localized – will unlikely be enough.

This is because there are several other factors to consider, including the general formatting preferences of Chinese websites, the more detailed product information, local reviews, etc.

Choosing the right payment localization partner

When your business is about to embark on a journey towards successful payment localization, partnering with the right company is essential for success.

Our TreviPay Network helps you to do business across international borders with ease thanks to automatic compliance with local laws and regulations. And our global B2B invoicing system provides invoicing capabilities for over 32 countries.

Conclusion

Exploring new markets and business opportunities can also bring risks. Careful payment localization takes effort but opens up global growth opportunities.

Understanding how payments will be made and received across borders is critical when evaluating international opportunities.

The market value of cross-border payments is skyrocketing, with projections indicating a significant compound annual growth rate and a significant increase expected in value in the near future.

Payment localization is playing a central role in cross-border transactions, offering a tailored approach to meet the preferences, regulations, and cultural norms of specific markets.

There are key considerations regarding payment localization, including:

- Local payment methods (e.g., credit and debit cards, digital wallets, bank transfers, trade credit)

- Currency conversion

- Language support

- Compliance with regulatory requirements e.g., data protection laws, anti-money laundering regulations)

- Cultural nuances related to payment preferences and practices

Understanding and adapting to local preferences around these issues can make a big difference.

By adapting payment methods, systems, and interfaces businesses can improve the user experience, improve conversion rates, and foster trust and loyalty among customers.

However, it also presents challenges including navigating diverse regulatory requirements, addressing cultural nuances, and managing language support.

A successful global expansion strategy prioritizes a streamlined, localized payment experience, no matter where customers are and what channel they engage with.

Explore 7 Important B2B Payment Considerations and prepare your business for successful global expansion today.