Cashflow can be a problem for many businesses – including those in the business-to-business (B2B) space.

For many businesses, the most obvious solution to a cashflow problem is to apply for a business loan. But this usually requires a time-consuming application and approval processes.

To resolve it more quickly, there are two other popular options:

- Receivables financing

- Invoice factoring

In this article, we will look at what they are, the advantages, disadvantages and differences between them and how to decide which one you should use.

Accounts receivable definition

Accounts receivable (also known as AR or A/R) are invoices (accounts) that have been issued by a company but are not yet paid (receivable) by its customers.

They arise when goods or services are provided but payment is not immediately required (i.e., when they are accounts payable). They are classed as assets on balance sheets.

The average collection period (the time between when an invoice has been issued and paid back in full) is often 30 days but it can vary, especially across industries.

What is receivables financing?

Receivables financing (also known as accounts receivable financing) is a lending solution whereby the accounts receivable of a business (i.e., invoices) are used to secure capital.

The invoices act as assurance to a third party, usually a bank, which provides an interim loan between the invoices being issued and settled.

The amount of the loan granted is usually 75 – 85% of the total value of the accounts receivable. Interest on the loan is charged until the amount borrowed is paid back in full.

Not all of a company’s accounts receivable are necessarily financed. The client usually chooses which of its customer’s invoices it wants financing for – but not which specific invoices.

If a client wants to specify which receivables are financed, they should choose ‘selective receivables financing’.

Advantages of receivables financing

The primary benefit of receivables financing is that is it provides a relatively quick source of cashflow so companies can instantly direct funds to where it is most needed.

It also helps companies maintain revenue stability. This is particularly useful for B2B companies whose clients often make larger but less frequent purchases than B2C scenarios.

Unlike traditional business loans from banks, receivables financing is based on existing not estimated earnings, so is relatively safe. Though payment hasn’t been received yet, the purchase has already been made and products have been supplied.

Of course, customers can occasionally default on outstanding invoices. The likelihood of this is calculated by the financing provider beforehand.

Disadvantages of receivables financing

The primary disadvantage of receivables financing is that it costs more than regular business loans.

Exactly how much more depends on a number of factors, including whether the provider is a traditional bank or a factor (see below, ‘Banks and factors’).

What is invoice factoring?

Invoice financing is a specific type of receivables financing usually available from an alternative funding provider.

It provides users with close to the full amount (97 – 99%) of their accounts receivable’s value, minus the factor provider’s fee. The majority of this amount (75 – 85%) is paid upfront.

Invoice factoring companies are likely to offer to take responsibility for collections. This may be an attractive option for suppliers looking to conserve their own valuable time and resources.

For more information on the likely costs, read our article, ‘How Much Does Invoice Factoring Cost?‘.

Advantages of invoice factoring

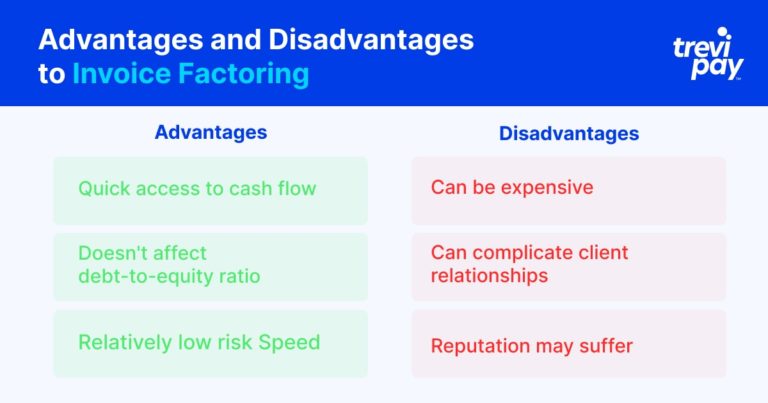

Invoice factoring provides a very quick way for companies to access cashflow.

Technically it is not lending, but an asset purchase. Because of this, it is not considered a loan, so it does not affect your debt-to-equity ratio. Invoice factoring is therefore a relatively low risk method of financing.

When used in conjunction with the factoring provider’s collections services, it can also save time.

Disadvantages of invoice factoring

Invoice factoring can be relatively expensive.

When collection services are provided, it can complicate client relationships. Communications and terms suddenly being controlled by a third party can be unnerving for some clients.

Similarly, a company’s reputation may suffer if it becomes common knowledge that they are using factoring services. Also, their clients may react negatively if the factoring company is less flexible about its terms than was usual.

What is the difference between receivables financing and invoice factoring?

The differences between receivables financing and invoice factoring are:

- Invoice factoring is often a faster way to access the value of outstanding invoices than invoice financing

- Invoice factoring often includes collections but invoice financing does not

- Invoice factoring provides a higher percentage of the invoice value than invoice financing

- Invoice financing and invoice factoring have different fee structures

Banks and factors

Another major difference between receivables financing and factoring is the service providers.

Generally speaking, banks provide receivables financing. Specialist alternative lenders (often in fintech) provide both financing and factoring services.

There are five main differences between what banks and receivables financing providers (often known as factors) offer:

- Speed of approval: Banks have relatively stringent due diligence processes but many factors in fintech use technology to generate almost instant decisions.

- Collections process: Banks don’t participate in the collections process of invoices, whereas many factors offer this option.

- Process category type: Banks provide a loan (with invoices as collateral), whereas factors directly purchase invoices. This distinction can influence credit scores.

- Amount of invoice value provided: Banks generally provide less of the value of outstanding receivables (between 75 – 85%) than factors (up to 99%).

- Fee structure: Bank fees are based on an interest rate for the loan they provide. Factors charge a percentage (usually between 1 – 3%) of the total invoice value.

Receivables financing vs factoring: Which one should you choose?

Business owners typically need to make decisions around cashflow quickly and under pressure.

At first glance, the difference between factoring and financing looks minimal. However, the consequences may be felt in both the short and the long term.

To help you choose the right solution, we recommend considering the following three questions:

1. How urgently is cash/capital needed?

Both receivables financing and factoring are typically much quicker to access than a traditional business loan.

Of the two, invoice factoring is likely to be the faster option.

2. How much capital is needed?

Exactly how much cashflow a company requires is an important consideration.

Invoice factoring provides a higher percentage of an invoice’s value than invoice financing.

3. How much of an issue are collections?

There are two main considerations around collections:

- How they affect your resources. During periods of high growth or major change, a factoring company could help keep your resources focused on priority activities.

- How they affect your client relationships. When collections are made by the factor on a supplier’s behalf, the supplier’s customers may interpret this negatively. Though the supplier’s motivation may be financing growth and innovation, customers might see it as a signal of financial difficulty.

If giving full control of collections to a factoring company could potentially negatively impact key business relationships, companies are likely to find receivables financing is a better option.

But if this is not an issue, and companies feel they will benefit from outsourcing collection, then invoice factoring is likely to be the superior choice.

Conclusion

Ensuring positive cashflow is vital to every business and there are now more options than ever for ways to do it.

Although bank loans remain an option, receivables financing and factoring are popular and proven ways for businesses to unlock working capital quickly.

The differences between the two solutions lie in the following aspects: speed of approval, collections process, process category type, amount of invoice value provided and their fee structure.

When looking for a cashflow solution for your business, make sure to evaluate fintech providers who may be able to offer an attractive alternative.

There are different rates and value-added services to consider (collections, for example) and different issues to prioritize.

Utilized effectively, both of these solutions can ultimately contribute enormously towards your company’s growth.