B2B payment automation is becoming increasingly essential in today’s dynamic business landscape. This technological advancement allows large businesses to streamline their financial processes, resulting in significant efficiency and cost savings. By opting to automate B2B payments, companies can reduce manual errors, expedite payment cycles, and enhance overall operational productivity.

B2B payment automation not only simplifies complex transactions but also ensures a more reliable and secure payment environment. As businesses continue to scale, the need for efficient payment solutions becomes paramount, making B2B payment automation a critical component for sustained growth and competitive advantage.

What is B2B Payment Automation?

B2B payment automation uses technology to manage business transactions without manual intervention. It includes functions like invoice processing, payment approvals, and fund transfers. Unlike traditional payment processes, which are manual and prone to errors, automated systems streamline tasks, ensuring faster and more accurate transactions. Learn more about B2B payment automation solutions.

Historically, payment processing involved manual data entry, approval workflows, and reconciliation leading to delays and mistakes. Automated systems perform these tasks quickly and accurately, reducing processing time and minimizing errors. This efficiency is crucial in modern business transactions.

How B2B Payment Automation Works

B2B payment automation involves key components like APIs, electronic invoicing, and automated payment scheduling. These components and technologies create a comprehensive B2B payment automation ecosystem, streamlining processes from invoice receipt to payment reconciliation.

APIs enable seamless integration between systems, allowing real-time data exchange. Electronic invoicing automates invoice generation and delivery, reducing manual input and errors. Automated payment scheduling ensures timely transactions by setting up payments based on predefined rules.

The workflow begins with invoice generation, followed by automated approval and payment scheduling. Finally, the system reconciles payments with invoices, ensuring accuracy. Robotic process automation is frequently used in the automation process to automate repetitive tasks.

Often B2B payment automation includes embedded payment options. A solution like TreviPay, can combine payment automation with credit management and B2B financing to complete order-to-cash automation.

B2B financing solutions address common challenges in B2B transactions, such as long payment cycles, cash flow constraints, and the need for working capital. Integrating these technologies through a payment orchestration platform ensures seamless operation and maximizes the efficiency of the payment automation ecosystem.

TreviPay’s API-first solutions streamline the payment processes along with credit management, accounts receivables and risk management, providing efficient and scalable B2B payment automation.

Types of B2B Payments

ACH Transfers

ACH transfers are electronic payments made through the Automated Clearing House network, ideal for recurring transactions due to their low cost and reliability. They are commonly used for payroll, vendor payments, and direct debits. Automation of ACH transfers simplifies batch processing and ensures timely transactions without manual intervention.

Wire Transfers

Wire transfers are immediate electronic transfers between banks, used for large, time-sensitive payments. The benefits include speed and security, making them suitable for international transactions. Automating wire transfers reduces the risk of errors and delays, ensuring funds are transferred swiftly and accurately.

Electronic Checks

Electronic checks, or e-checks, are digital versions of paper checks, offering a secure and efficient way to handle payments without the need for physical checks. They are useful for businesses transitioning from paper to digital payments. Automation streamlines the creation, sending, and processing of e-checks, reducing the time and cost associated with traditional checks.

Cash

Cash payments, though less common in B2B transactions, can be automated through secure vault services. Cash transactions can lower processing costs, but it comes with significant drawbacks including the risk of theft, administrative overhead due to the additional records needed, and the physical requirements of a cash transaction. These factors severely restrict the use of cash in modern global commerce, particularly for online and cross-border transactions.

Credit Cards

Credit cards, including virtual cards, provide flexibility and immediate payment. Automation of credit card transactions ensures secure and efficient processing, reducing the risk of fraud and errors. Credit card fees can be expensive, especially for international purchases.

Virtual cards work like credit cards but exist only online. Some companies don’t use them because their financial systems can’t process them.

Electronic Payments

Electronic payments encompass various methods such as digital wallets and online payment platforms. They offer convenience and speed, making them increasingly popular in B2B transactions. Automating electronic payments integrates these methods into a seamless system, enhancing efficiency and accuracy.

Automating these various payment types simplifies management by integrating them into a single, cohesive system. This reduces the administrative burden, minimizes errors, and enhances overall financial efficiency.

Benefits of B2B Payment Automation

Automating B2B payments offers significant benefits. Automation reduces manual errors, accelerates payment cycles, and streamlines financial processes, freeing up valuable resources.

TreviPay’s solutions enhance these benefits with advanced features such as real-time data integration and automated reconciliation. This results in fewer payment delays, better cash flow management, and enhanced vendor relationships. By implementing TreviPay’s automation solutions, businesses can achieve a higher level of operational efficiency and accuracy, positioning themselves for sustained growth and success in the competitive market.

Cost Efficiency and Savings

The choice to automate B2B payments significantly reduces operational costs by minimizing manual processing and errors. For example, businesses using automated systems report savings on labor and reduced late payment fees.

TreviPay’s cost-effective payment solutions offer features like electronic invoicing and real-time reconciliation, further enhancing savings. Companies that adopt TreviPay’s solutions benefit from streamlined processes and improved financial accuracy, leading to substantial cost reductions. By integrating automation, businesses can allocate resources more efficiently and enhance their overall financial performance.

Improved Cash Flow Management

Automated B2B payments enhance cash flow management by ensuring timely and predictable payments. Faster payment cycles improve business liquidity, enabling companies to manage their finances more effectively.

Automation reduces the time from invoice generation to payment receipt, providing better visibility into cash flow. It also decreases invoice errors which lead to invoice disputes and payment delays. This predictability allows businesses to plan and allocate resources more efficiently.

TreviPay’s solutions support these benefits by offering real-time payment processing and combined with trade credit and A/R automation can decrease DSO to zero days.

Enhanced Security and Risk Management

Automating B2B payments enhances security by reducing fraud and protecting sensitive data. Automated systems use encryption and secure payment processing to safeguard transactions.

TreviPay offers advanced risk management tools, including real-time monitoring and fraud detection, ensuring secure payments. Additionally, automated systems help businesses comply with regulatory standards, reducing the risk of non-compliance. By leveraging TreviPay’s secure and compliant payment solutions, businesses can mitigate risks and protect their financial transactions from potential threats.

Better Supplier Relationships

Automated payments improve supplier relationships by ensuring timely and accurate payments. The Institute of Finance and Management conducted a survey that found that 39% of invoices contain errors. These mistakes can vary from minor errors like wrong billing addresses to more serious problems such as overcharging or repeated payments. Errors lead to damaged relationships between the company and its customers.

TreviPay’s automation solutions have reported stronger supplier relationships due to prompt payments and reduced disputes. A manufacturer using TreviPay, reported growing sales by 42x and increased dealer loyalty with automated payments.

Automation fosters trust and reliability, which can lead to more favorable credit terms and discounts. Timely payments enhance customer satisfaction and loyalty.

Why B2B Payment Automation is on the Rise

The adoption of B2B payment automation is driven by market trends and technological advancements. Innovative B2B payments solutions are increasingly integrating the best of B2C payment models as B2B buyers expect a B2C experience.

Covid accelerated digital transformation and the need for integration with other systems like ERP and accounting software. Digital transformation has accelerated efficient and scalable payment solutions. Large enterprises demand streamlined processes to handle high transaction volumes, reducing operational costs and improving accuracy. The rise of eCommerce and global trade further boosts the need for automated payment systems.

According to TreviPay’s insights, businesses are increasingly turning to automation to enhance efficiency and stay competitive. This trend reflects the growing emphasis on digital solutions to meet evolving business needs.

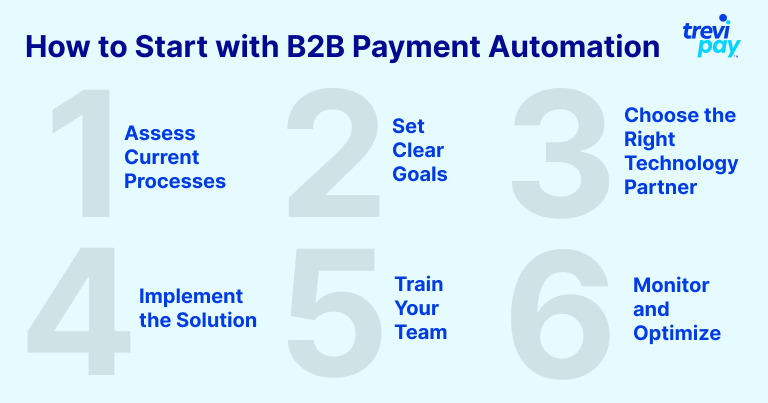

How to Start with B2B Payment Automation

Step-by-Step Guide

- Assess Current Processes: Evaluate your existing payment workflows to identify inefficiencies and areas for improvement. Understand how invoices, approvals, and payments are currently managed.

- Set Clear Goals: Define what you aim to achieve with automation, such as reducing processing time, minimizing errors, or improving cash flow management.

- Choose the Right Technology Partner: Select a reliable partner like TreviPay, known for their expertise in B2B payment automation. Look for features that align with your business needs.

- Implement the Solution: Integrate the chosen automation system into your existing infrastructure. Ensure it supports electronic invoicing, automated payment scheduling, and real-time reconciliation.

- Train Your Team: Provide training to your staff to ensure they are proficient with the new system and understand the benefits of automation.

- Monitor and Optimize: Continuously monitor the performance of the automated system and make necessary adjustments to optimize efficiency.

In order to successfully automate B2B payments in your organization, choosing the right partner is crucial. TreviPay’s solutions offer comprehensive features to streamline your B2B payments. By implementing these steps, businesses can successfully transition to an automated payment system, enhancing overall efficiency and accuracy.

TreviPay’s B2B Payment Solutions: Driving Business Growth

TreviPay offers innovative and comprehensive B2B payment solutions designed to drive business growth. With TreviPay, businesses benefit from better cash flow management and timely payments, fostering stronger supplier relationships.

TreviPay improves efficiency by automating not just the payments but the order-to-cash processes, reducing manual errors and enhancing security through advanced fraud prevention tools. TreviPay’s solutions boasts of easy integration with its simple, well-documented APIs. Each one connects seamlessly with your eCommerce platforms, accounting software, or payment gateways.

Explore our A/R solutions to see how TreviPay can transform your payment processes. For a personalized consultation or to request a demo, contact TreviPay or request a demo. Experience the difference that TreviPay’s solutions can make for your business.