In today’s fast-paced and unpredictable business environment, managing cash flow and ensuring timely payments from customers are critical for long-term success. Trade credit insurance has become a vital tool for businesses looking to protect themselves from the risk of non-payment by customers. This type of insurance acts as a safety net, covering unpaid invoices when clients default or face financial difficulties.

Trade credit insurance, also known as accounts receivable insurance, safeguards businesses from significant losses. It provides peace of mind and helps maintain a healthy financial standing when offering trade credit to customers. Whether a company operates locally or globally, trade credit insurance plays a crucial role in reducing risk and enhancing business stability. This guide to trade credit insurance will help you navigate the complexities of it.

What Is Trade Credit Insurance?

Trade credit insurance definition is a type of coverage that protects businesses against the risk of non-payment from customers. Its primary purpose is to mitigate the financial risks of trade credit by covering outstanding receivables if a customer defaults because of insolvency or other financial difficulties.

Unlike other types of business insurance, trade credit insurance focuses specifically on the risk of non-payment from trade partners. It ensures that companies can continue operations even if major clients fail to meet their payment obligations.

By offering protection against non-payment, trade credit insurance helps businesses avoid financial strain, improve cash flow and maintain a stable credit management process.

How Does Trade Credit Insurance Work?

Trade credit insurance functions as a risk management tool for businesses that offer credit terms to their buyers. If a buyer defaults on payment, the insurance compensates the seller for the unpaid invoices, providing financial security. The process of obtaining a trade credit insurance policy starts with an application where the business provides details about its receivables, customer base and overall risk exposure.

Premiums Based on Coverage and Risk Profile

Once the insurer assesses the business’s risk profile, they assign a premium based on the volume of receivables and the likelihood of default. Higher-risk customers or industries lead to higher premiums. The insurer sets credit limits for each buyer, defining the maximum amount that the insurer can insure.

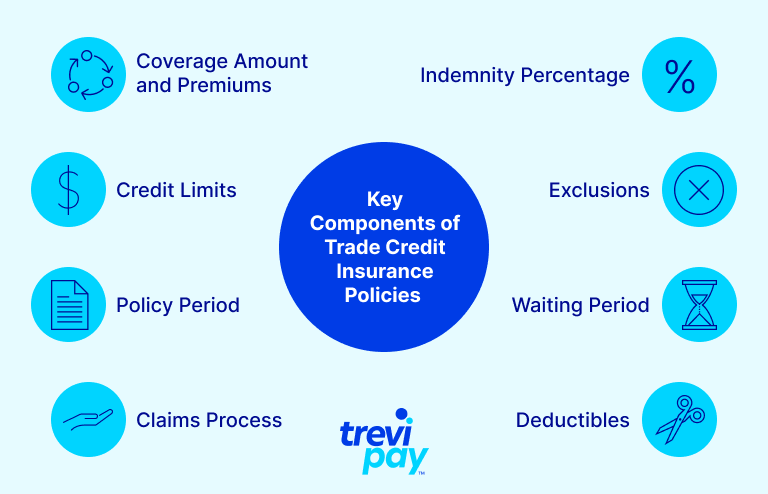

Key Components of Trade Credit Insurance Policies

Coverage Amount and Premiums: Coverage amounts depend on the size of the receivables and the financial health of the customers. Insurers calculate premiums based on the insured turnover and the risk level associated with the buyer’s payment history.

Credit Limits: Credit limits are the maximum amount covered per customer. The insurer assesses the buyer’s creditworthiness to determine these limits. This allows businesses to extend credit to customers while minimizing the risk of loss.

Policy Period: Insurers typically issue trade credit insurance policies for 12 months, and policyholders can renew them annually. The renewal process includes a review of the company’s risk profile and may lead to adjustments in premiums and credit limits.

Claims Process: In the event of a default, the business must file a claim with the insurer, providing documentation like unpaid invoices and proof of the buyer’s insolvency. The insurer evaluates the claim and once approved, the business receives a percentage of the insured debt as compensation.

Indemnity Percentage: The indemnity percentage refers to the portion of the debt covered by the insurer. Depending on the policy, this could range from 75% to 95% of the unpaid amount.

Exclusions: Common exclusions include pre-existing bad debts, disputes between buyer and seller and non-payment arising from unresolved contractual disagreements.

Waiting Period: After a default or insolvency event, a claimant must wait for a specified period before making a claim. This period allows for potential resolution before the insurer steps in.

Deductibles: Some policies include deductibles, meaning the business must absorb part of the loss before the insurer covers the remainder.

Policy Coverage and Limits

Trade credit insurance typically covers non-payment because of buyer insolvency, protracted default and sometimes political risks. Insurers often adjust coverage based on the financial health of individual buyers, revisiting limits throughout the policy period.

Policies limits and exclusions should be examined carefully. Trade credit insurance will not cover every reason that a client defaults. Insurers generally do not cover unwillingness to pay due to defective products or misunderstandings.

Benefits of Trade Credit Insurance

There are many benefits to trade credit insurance. It offers businesses valuable protection and financial stability by safeguarding against trade credit risk. The seller is no longer at risk of customer non-payment and insolvency. This coverage helps maintain consistent cash flow, even when clients default on their invoices, enabling better financial planning and operational management.

Without trade credit insurance, businesses face a higher risk of financial loss due to non-payment from customers, which can lead to the use of debit collector services to recover outstanding debts. Debt collection services are third-party agencies or companies that specialize in recovering unpaid debts on behalf of businesses or individuals. These services either receive a percentage of the amount recovered or buy the debt from the business for pennies on the dollar.

Key benefits of Trade Credit Insurance are:

Protection Against Bad Debts: The primary benefit of trade credit insurance is its protection against customer insolvency and non-payment, ensuring that businesses do not suffer crippling losses.

Improved Cash Flow Management: By providing coverage for unpaid invoices, trade credit insurance helps businesses maintain cash flow, even when clients default on payments. This stability allows for better financial planning and operational management.

Enhanced Credit Management Practices: Trade credit insurance strengthens a business’s credit management by allowing more informed decisions on credit terms and customer risk. Companies can confidently extend credit because they protect themselves against non-payment risk.

Peace of Mind and Financial Stability: With the right trade credit insurance, businesses can focus on growth and expansion without worrying about potential financial setbacks from non-paying clients.

What Commercial Risks Does Trade Credit Insurance Cover?

Trade credit insurance offers comprehensive coverage for various commercial risks that businesses may face when dealing with customers. Key risks it covers include:

Customer insolvency: Protection against buyers who declare bankruptcy and cannot pay.

Protracted default: Coverage for customers who fail to pay within an agreed-upon period in the payment terms.

Political risks: In some cases, insurance covers payment defaults resulting from political events such as unrest or trade embargoes.

By covering these risks, trade credit insurance offers businesses valuable financial protection and the ability to focus on growth, even in uncertain times.

How to Choose the Right Trade Credit Insurance

When choosing the right trade credit insurance, businesses should carefully evaluate several key factors to ensure they select a provider that meets their specific needs and provides reliable coverage.

First, consider the experience of the insurer. Opting for a provider with a strong reputation and proven track record in the industry is essential. Experienced insurers are more likely to have a deep understanding of market trends and risk factors, and they will be better equipped to offer tailored solutions based on your business’s industry and size.

Next, assess the coverage options available. Each business has distinct risk profiles and credit management requirements, so it’s crucial to locate a provider that delivers adaptable policies. The perfect insurer should offer tailor-made coverage matching your company’s risks. Some insurers focus on export credit insurance, a policy that safeguards a business’s accounts receivable from the danger of non-payment by overseas buyers. Choosing an insurance that considers whether you operate locally or globally or require protection for a wide customer base or certain high-risk accounts, is significant.

Customer service is another critical factor to consider. Trade credit insurance involves ongoing communication and claims management, so selecting a provider with responsive, accessible, and personalized customer service is key. An insurer that prioritizes quick response times and hands-on support can make the claims process smoother and provide valuable guidance on credit management best practices.

For some businesses, alternative solutions may be preferable to traditional insurance. For example, companies might seek out payment guarantees, which reduce or eliminate the need for insurance policies altogether. TreviPay offers comprehensive trade credit solutions that go beyond standard insurance by guaranteeing payments, which can help businesses avoid risks like chargebacks that are common with credit card transactions. This type of solution ensures financial security while simplifying the payment process, giving businesses confidence in their cash flow management without relying on conventional insurance models.

By considering these factors, businesses can choose the right trade credit insurance provider or alternative solution that aligns with their goals and risk management needs.

Partnering with TreviPay as an Alternative to Trade Credit Insurance

TreviPay provides innovative trade credit financing and risk management solutions that go beyond traditional insurance. With TreviPay, businesses benefit from guaranteed payment and expert support, allowing them to focus on growth rather than risk management. Additionally, TreviPay’s advanced risk assessment tools and tailored solutions ensure that businesses receive the support they need to thrive.

To learn more about how TreviPay can meet your trade credit needs, contact us, explore our solutions, or request a demo.