Finance teams face increasing pressure to deliver faster, more accurate insights. Traditional Financial Planning and Analysis (FP&A) processes, often dependent on historical data and manual work, are struggling to keep up with modern demands. To meet these challenges, businesses are turning to AI to optimize their FP&A functions and enhance decision-making.

Dr. Beadle Navaraj, Finance Practice Lead & Senior Partner, CFO Advisory & AI Transformation at WNS, discusses how AI integrated with human intelligence is transforming FP&A in “4 Levers to Transform FP&A with an AI-augmented Center of Intelligence.” This article covers four key areas for modernizing FP&A processes:

- AI-powered Dynamic Data Ingestion: One of the critical challenges in FP&A is managing and integrating data from multiple sources. AI facilitates seamless data ingestion, providing finance teams with real-time, accurate information across various platforms. This enables businesses to enhance forecasting accuracy and generate dynamic, up-to-the-minute views of financial performance, ensuring better alignment with current business conditions.

- Intelligent Automation: Routine tasks like manual data entry, reconciliations and report generation consume time and resources, diverting attention from high-value activities. AI-driven automation eliminates these repetitive tasks, allowing finance teams to focus on strategic planning, financial analysis and value-added initiatives. By automating routine workflows, organizations can improve efficiency and reduce operational bottlenecks.

- Advanced Analytics: Leveraging AI-powered predictive and prescriptive analytics enables companies to move from reactive decision-making to proactive financial planning. Advanced analytics allows finance teams to anticipate future trends, model potential outcomes and make smarter, data-driven decisions that directly impact business growth. AI not only enhances the quality of insights but also accelerates the decision-making process.

- Self-service Reporting: AI-driven, self-service reporting capabilities offer finance teams greater flexibility and independence in generating insights. With user-friendly tools, teams can quickly access and tailor reports to their specific needs without heavy reliance on IT support. This agility empowers finance professionals to provide timely insights to leadership, supporting quicker responses to shifting market conditions.

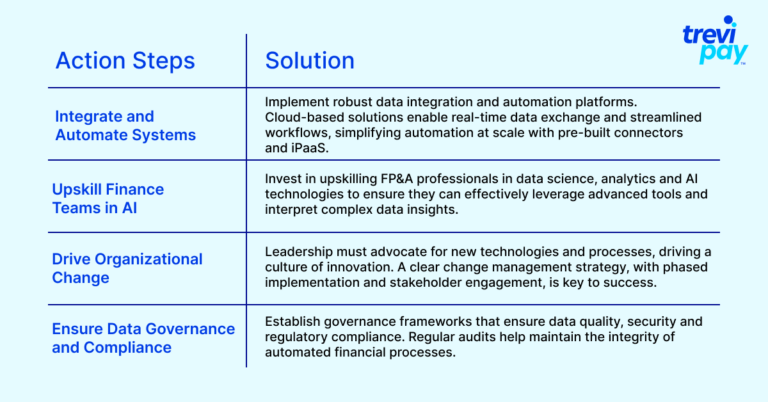

To transform FP&A into a Center of Intelligence, organizations must address several challenges and implement strategic solutions:

Dr. Navaraj’s insights provide a clear roadmap for finance professionals looking to modernize their FP&A processes. By leveraging AI across these four key levers, organizations can not only enhance the accuracy of their financial decision-making but also improve agility and responsiveness in a rapidly evolving business environment. AI-driven FP&A solutions are not just a competitive advantage—they are becoming a necessity for companies aiming to stay ahead of the curve.

By combining human expertise with AI-driven technologies, FP&A teams can deliver more accurate, actionable insights, supporting strategic decision-making and long-term business growth. Read the full report, “4 Levers to Transform FP&A with an AI-augmented Center of Intelligence.”