Acquiring and retaining customers is the top priority for B2B businesses. As companies strive to expand their reach both nationally and globally, having a robust B2B customer acquisition strategy is essential. Net terms financing is a strategy for customer acquisition and expansion into B2B, as it is the preferred payment method for B2B buyers. 85% of buyers want to pay with trade credit. In addition, 72% of B2B buyers are more loyal to a business that offers their preferred payment method. In fact, the strongest seller-buyer relationships are significantly affected by the payments process.

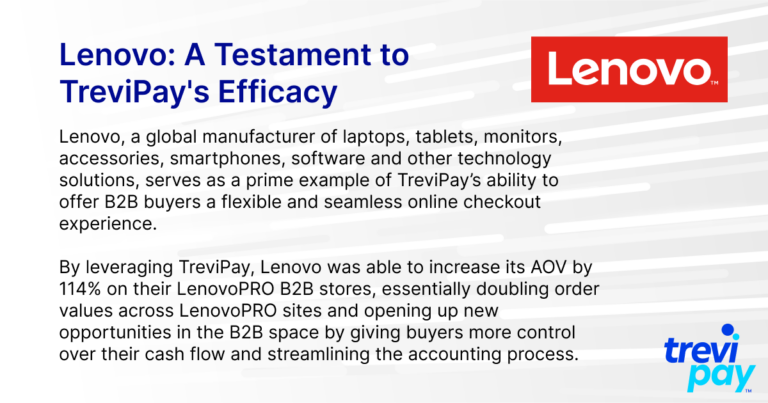

At TreviPay, we understand the significance of robust customer acquisition strategies in B2B payments, which is why we’re proud to offer Universal Acceptance, in partnership with Mastercard, making it faster than ever to launch a net terms program. TreviPay’s Universal Acceptance can be leveraged to not only streamline payments, but also unlock global growth opportunities for businesses across industries. Offering trade credit makes it easier for B2B buyers to do business with you, resulting in increased AOV and reduced DSO for suppliers.

Understanding Net Terms as a B2B Customer Acquisition Strategy

In B2B transactions, acquiring customers is not just about showcasing a product or service; it’s about creating the payment experience that makes B2B buyers want to do business with you time and time again.

It’s about reaching out to potential clients, nurturing relationships and understanding the intricacies of their needs and pain points. A comprehensive B2B strategy enables businesses to adapt to various market conditions and stay ahead of competitors, ultimately driving sustainable growth and capturing more share of wallet.

B2B businesses can’t rely solely on net terms or credit cards alone for customer acquisition, they need both. Universal Acceptance provides buyers with the ease of paying by card and the benefits of paying by invoice.

TreviPay Universal Acceptance makes it easier for suppliers to offer trade credit to business customers, reducing upfront costs and credit approval barriers while accelerating suppliers’ speed to market. TreviPay’s patent-pending innovative B2B payment technology authorizes, clears and settles net terms transactions over an open-loop network utilizing the Mastercard payment network.

How Universal Acceptance Works

Speed-to-Market

One of the key aspects of Universal Acceptance is its seamless integration with point-of-sale (POS) systems, eliminating the need for manual entry of payment information, reducing errors and enhancing efficiency. By seamlessly integrating with existing POS infrastructure, TreviPay ensures a smooth and hassle-free payment experience for both businesses and their customers.

Rapid Integration

Suppliers can offer net terms financing to business customers with little to no integration work, as long as they already accept Mastercard. This significantly reduces the time to implement and onboard. The familiar payment system reduces the time to implement and integrate. With Universal Acceptance by TreviPay and Mastercard, the integration work is removed, greatly reducing upfront costs and time to market.

TreviPay and Mastercard’s Universal Acceptance goes beyond traditional credit acceptance methods, offering businesses a seamless and efficient way to do business globally. By simplifying payment processes and providing flexible financing options, TreviPay empowers businesses to expand their reach and streamline operations, ultimately driving customer acquisition and retention.

Leveraging TreviPay’s Convenient B2B Payments Platform

With features designed to streamline invoicing and optimize cash flow, businesses can focus on what matters most— expanding their customer base, increasing AOV and driving revenue. The convenience and efficiency of TreviPay’s Universal Acceptance solution positions businesses as a catalyst for accelerated growth in the B2B ecosystem.

Global Expansion with TreviPay

International B2B payments present a myriad of hurdles, from currency conversion complexities to navigating diverse regulatory frameworks and addressing the risk of fraud. These challenges can significantly impede the efficiency and reliability of cross-border transactions, ultimately hindering expansion efforts. This is where TreviPay steps in, with its comprehensive solution that facilitates seamless global transactions and speeds up the pace of international expansion.

Universal Acceptance from TreviPay and Mastercard is tailored to overcome the obstacles inherent in international B2B payments. By providing a unified solution that supports multiple currencies and complies with global regulatory standards, TreviPay streamlines the payment process and minimizes the complexities associated with cross-border transactions. Universal Acceptance enables efficient global rollout of B2B payments through:

Managing International Payments

TreviPay operates in 32 countries and 20 currencies and facilitates transactions when the seller invoices, and they can then pay in a currency different than the one disbursed to the merchant. This enhanced trade credit capability bolsters buyer loyalty, which begins with payment. Businesses see a 10% boost in cross-border transaction volume.

Compliance

Meeting constantly changing standards can create financial implications. TreviPay’s Universal Acceptance eases this burden by expertly navigating the complexities of AML and KYC compliance.

Get Started with Universal Acceptance

While offering net terms through TreviPay and Mastercard’s Universal Acceptance solution can play a pivotal role in customer acquisition, it’s essential to consider complementary strategies. By integrating Universal Acceptance with other acquisition channels, businesses understand and can better cater to the B2B buyer segment, ensuring maximum impact and sustained growth. TreviPay and Mastercard’s Universal Acceptance program is more than just a payment solution—it’s a catalyst for unlocking global growth opportunities. By streamlining B2B payments and facilitating seamless transactions, TreviPay empowers businesses to expand their customer base, increase AOV and drive revenue.

As companies navigate the complexities of customer acquisition, TreviPay stands as a trusted partner, enabling businesses to thrive in a rapidly evolving marketplace. Contact us today to determine if Universal Acceptance by TreviPay and Mastercard is the right solution for your B2B payments strategy.