Without customer satisfaction built into your B2B growth strategy, you might run into some unnecessary growing pains. Invoicing is an essential consideration to include in your strategy. As part of a comprehensive smart approach, it’s important to understand that invoicing B2B customers is significantly more complicated than invoicing B2C customers. Having a clear picture of your customers’ unique requirements — and being able to deliver on is essential to creating a standout customer experience and ensuring efficient collections.

A common requirement includes getting the invoice into the customer’s ERP system or custom portal. In a recent survey we conducted, 80% of respondents said it was very or extremely important that sellers offer an ERP system. While this used to be a requirement solely for larger enterprise customers, it’s now more common for customers of any size to use an ERP system — a third of all TreviPay portal customers have active credit lines less than $5K, representing smaller buyers on our networks.

As you look to grow your B2B business sales, embracing a customized portal and a strategy to scale eInvoicing capabilities with quality becomes non-negotiable.

eInvoicing is a broad term that I use to describe the many ways to get invoices into ERPs and portals. These eInvoicing solutions vary from manual and time-consuming processes to sophisticated automations.

Scaling with Quality is the Solution

Automation will be vital to scaling eInvoicing abilities. Without automation, more team members will be pulled into this labor-intensive work and away from activities that help the business grow. Tragically, the salesperson is usually the one who absorbs the additional manual work. Great salespeople want to deliver exceptional service to their customers, so they jump in to remove any invoicing friction. Sales teams have support in the form of automation — and automation is also the direct path to quality. It’s the one way to ensure a consistent and accurate process that meets the customer’s needs. Automation removes the element of human error.

If you’re relying on manual processes, you could be missing out on revenue opportunities.

Manual invoicing and paper processes guarantee friction throughout the buyer payment experience. Worse, buyers may experience more errors and longer invoice processing times. This is especially painful for bigger buyers with a significant volume of invoices. We see the true price of manual invoicing in the loss of wallet share. Alternatively, with properly executed eInvoice integrations, according to one of our internal studies, merchants see an average monthly spend increase of 97%.

How much eInvoicing automation can you achieve?

There are three drivers to factor into the level of sophistication and automation of your eInvoicing capabilities:

Driver #1: Return on Investment (ROI) – Depending on the volume of invoices per customer, the ROI on your automation investment could take years to recoup. Until you reach certain volume thresholds, you might decide manual entry is best at first. Luckily, at TreviPay, we can recoup our investment much faster because we achieve the volume by combining multiple customers across our various networks. Doing business with TreviPay gives you a marked advantage over going at this alone.

Driver #2: Customer Involvement – Although the customer sets these requirements, the customer’s assistance is often required to achieve a quality automation. Their technical resources may or may not be available to help with the specifications and testing. Even with their attention, this can be a lengthy process of building files, sending them for testing, understanding defects, running a new test file and repeating the process until the file loads perfectly. Without proper customer involvement, many times these automations can stall out.

Driver #3: ERP/Portal Ease of Use – With eInvoicing capabilities, companies can solve several buyer expectations that make it easier for buyers to do business with them. Still, integration into a buyer’s back-office ERP system can be complex and often off-putting to buyers during onboarding. These barriers drive sellers to find an easy way to integrate into their back-end systems. The solution also varies depending on the ERP or custom portal and how easy it is to interface with. You’ll want to factor in APIs, the ability to upload, complicated fundamental screens and invoicing requirements.

Taking the time to understand these three drivers before you invest in eInvoicing automation will help you create a higher-quality solution.

eInvoicing automation reduces errors, redundancies and repetitive work.

Various automations to consider:

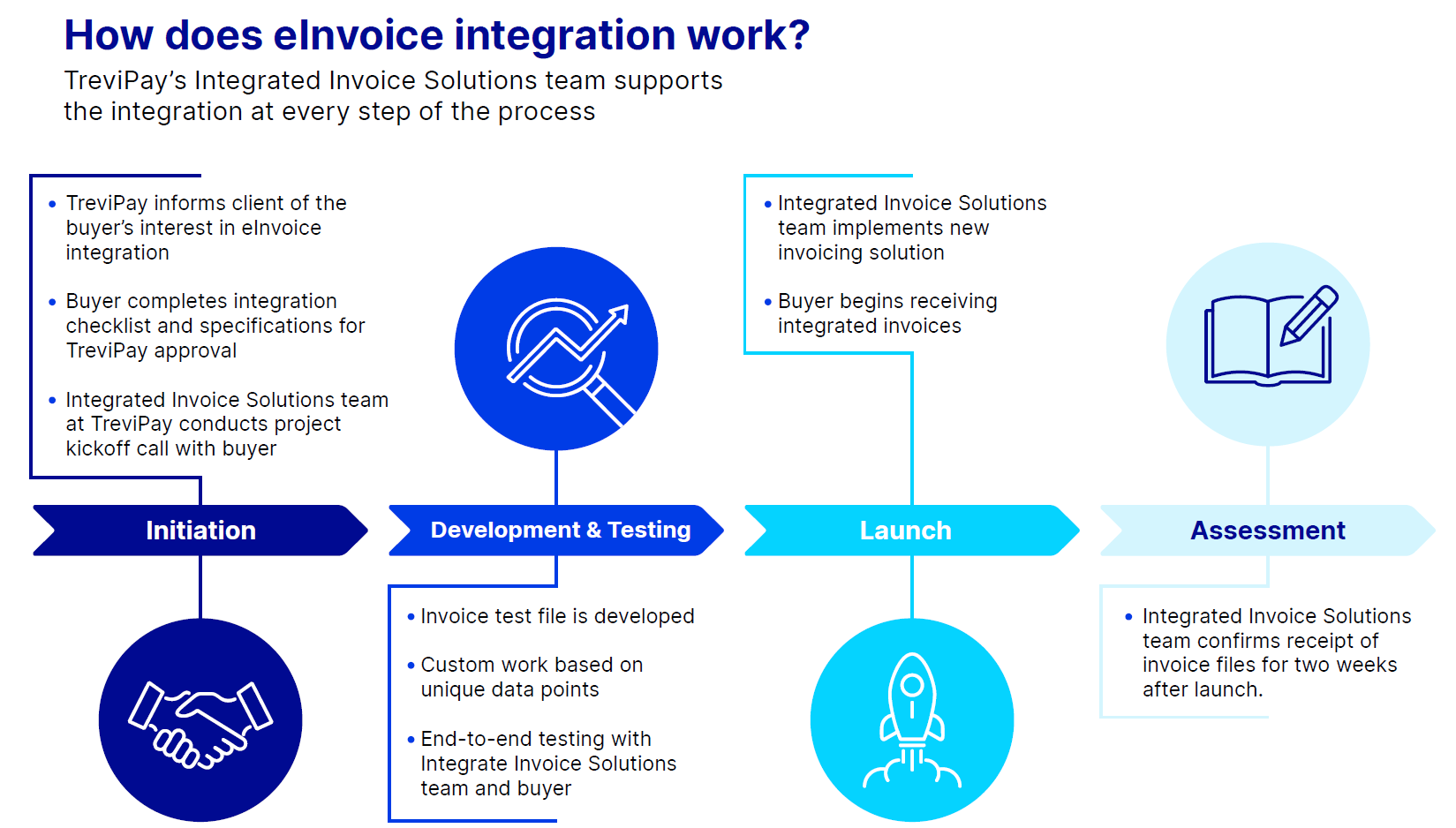

- TreviPay has built several eInvoice integrations. We use an ETL (extract, transform, and load) platform that allows us to match the unique data requirements needed for the various ERPs and portals. These integrations are then coded to deliver information directly into the customer’s system. The image below shows you how we support the integration at each stage.

- TreviPay uses Robotic Process Automation (RPA) embedded within workflows to retrieve the invoice data and then enter it into the ERP/Portal user interface with no human intervention.

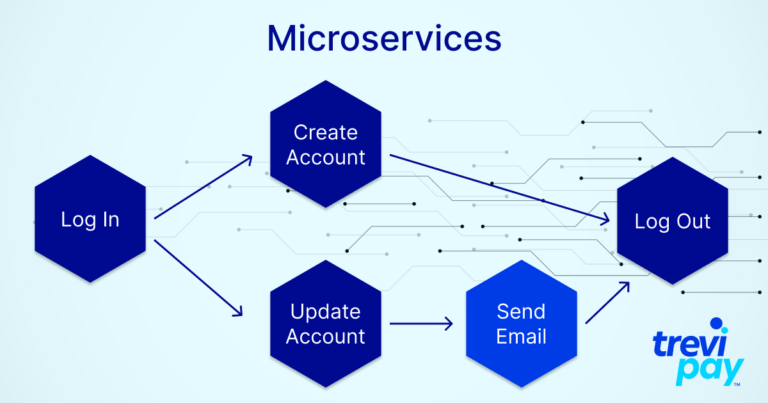

The invoice entry screens within ERPs and Portals change quite a bit, so how the RPA processes are built is very important. Remember to use micro-service processes rather than end-to-end processes.

TreviPay has invested several years into perfecting this process so we can now do this accurately and at scale while keeping costs down for our partners. You can accelerate your RPA journey faster than you think.

In the image below, you see four microservices. Log in, create an account and logout or update the account, send an email and log out.

All the things above mitigate potential friction in the invoicing process. As a last resort, some invoices may still require manual entry.

Now that you’ve understood your drivers and considered which automations to deploy, you’re not quite done yet.

Getting invoices into ERPs/Portals is the first step — which many think is the hardest part. Next, there are potential invoice discrepancies to consider. If an invoice is missing a PO number, the portal will reject it. Now, we need to make sure the invoice is accepted and exceptions are addressed quickly.

How to avoid invoice discrepancies:

Invoice entry, although a critical step, isn’t the only process that needs to be automated. Be prepared for the rejected invoices. With the sophisticated rules within the portals, like PO requirements, item validations and pricing validations, many invoices won’t be accepted and will be denied either at invoice entry or shortly after that.

We have found RPA bots to be most effective for “listening” for these rejections, retrieving the details and creating work queues requiring manual resolution intervention. Once the issue causing the rejection is resolved, it’s now time to reenter the invoice into the ERP/Portal.

Finally, once invoices have been received and accepted, you’ll need to extract any payment information from the ERP/Portal in the form of a report or remittance advice. This information is necessary for understanding incoming cash flow and feeding into your cash application process. TreviPay automates this final, critical step using a combination of tools, RPA, OCR and workflow.

Focusing on a quality customer experience while scaling is key to creating loyalty.

The customer experience is the most meaningful consideration when planning your approach to eInvoicing. An effective eInvoicing process reduces the risk of mistakes, gets you paid faster, offers savings on manual processes and gives you greater visibility into opportunities for growth. And, of course, your customers will have the best experience.

Read our new guide “6 Ways to Bring Order to Your Order-to-Cash”