Create more profitable and loyal trading relationships on TreviPay’s global B2B payments and invoicing network. When using TreviPay’s net terms offering as a payment method, your business buyers can use trade credit to buy more, more often.

TreviPay’s array of payment methods and collection options are designed to optimize the order-to-cash process and enhance the financial performance of your business.

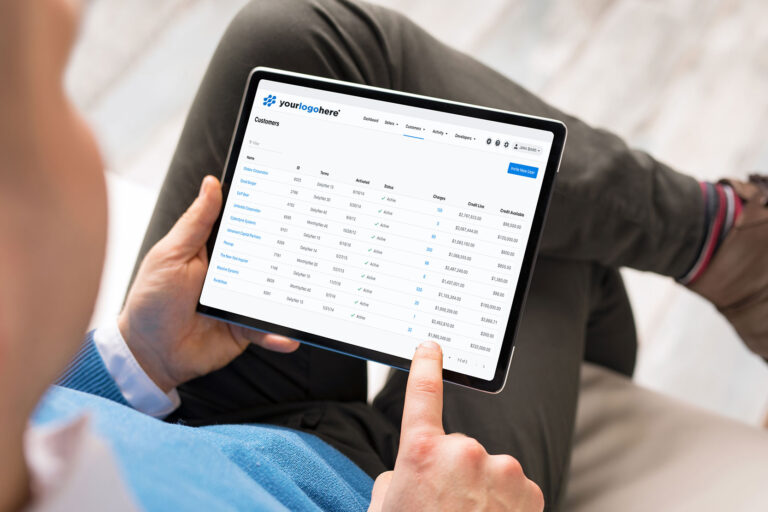

Quickly onboard buyers with a real-time application process with speedy prequalification and underwriting so buyers can start purchasing immediately.

Provide buyers with a unified purchasing experience across all channels – online, in-store or through the sales team.

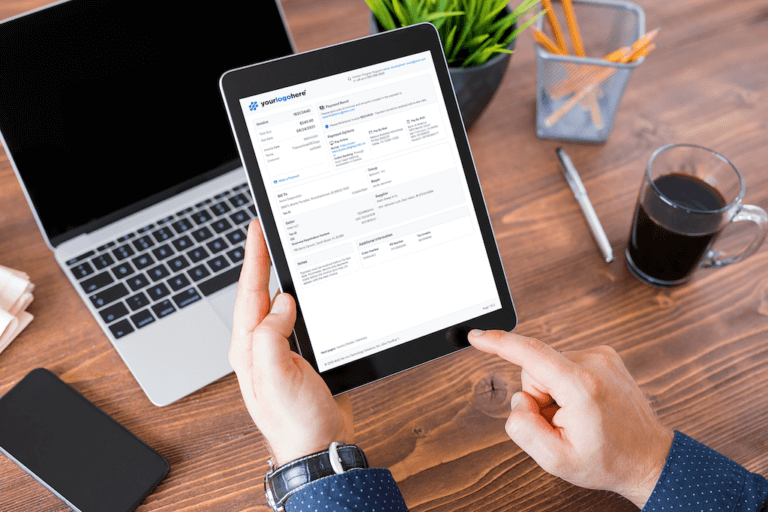

Automated processing ensures accurate and compliant delivery of invoices, in the correct currency, directly into the buyer’s ERP system.

A streamlined collection process with guaranteed payment.

Provide buyers statement-level reconciliation on a branded dashboard so they can pay in their preferred currency with direct debit, check or ACH.

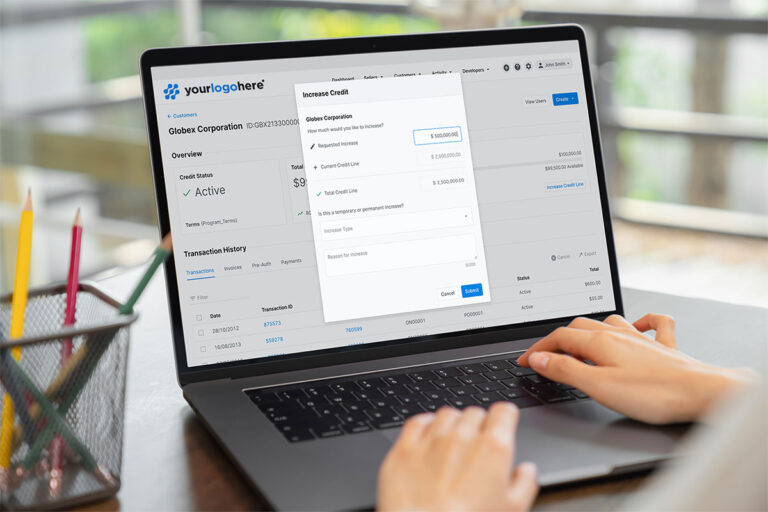

Make your working capital work for you. Choose from flexible funding options that include self-financing, using capital from TreviPay or a third-party bank.

With TreviPay’s payment methods and collection options, you can optimize the order-to-cash process and enhance the financial performance of your business.

Buyer Qualification and Automated Onboarding

Omnichannel Purchasing and Invoicing at Point of Purchase

Guaranteed Seller Settlement in as Little as 48 Hours

Buyer Payment Collected in Preferred Currency via Direct Debit, ACH or Check

At TreviPay, our end-to-end global payments and invoicing platform powers B2B commerce across industries and geographies. Explore our platform by solution type, business use case and expanded solutions with our strategic partners.

TreviPay’s technology and services are tailored to meet the specific needs of B2B commerce. Learn how our advanced payments and invoicing solutions can automate the order-to-cash process, making it simpler and more convenient for your customers to do business with you.

Partnering with TreviPay can accelerate your digital transformation, simplify international expansion and broaden your sales channels as part of your B2B payments strategy. Discover how teaming up with TreviPay can help you achieve your goals.

When you need an enhanced offering, we call on powerful industry leaders to collaborate. Our advanced solutions simplify launching and scaling a net terms program, reduce integration efforts and minimize the number of vendors you need to manage for the best payments experience.

TreviPay enables you to reach new markets, conduct cross-border trade, meet the demands of commercial clients and build loyalty.

Expand your customer base, reduce upfront costs, minimize credit approval barriers and accelerate suppliers’ speed to market.

Thank you to everyone who joined us for the first TreviPay Crossroads Conference! Stay tuned for more updates and recordings.

Learn how to choose the right tech provider, understand key market drivers, stay on top of mandates and develop advantages to support your business.